Behind the Scenes - Preparing for Deep Financial Analysis of the Venture Studio Model

A Deep Quantitative Analysis of the Venture Studio Model

The venture studio model stands at an inflection point. Early performance data suggests these systematic company builders are achieving superior returns—Vault Fund research shows venture studios delivering average net IRRs of 60% compared to 33% for top-quartile traditional venture capital. Yet beneath these headline figures lies a more nuanced story that demands rigorous analysis.

A critical note on data: The 60% average IRR is based on only 18 fully exited studio vehicles—and is being compared to top-quartile VC performance. As the dataset grows, we can expect better (and fairer) comparisons and an eventual shift to a direct comparison between top quartiles..

We're embarking on what we believe will be the most comprehensive quantitative analysis of the venture studio model to date. Our goal is to move beyond surface-level comparisons and develop a deep understanding of the structural advantages and challenges of the studio approach.

The Need for Deeper Analysis

The venture studio model fundamentally reimagines company creation. Unlike traditional venture capital's portfolio approach, studios build companies systematically, maintaining significant operational control and ownership from inception. This distinction drives meaningful differences in everything from capital efficiency to risk management—differences that existing analytical frameworks struggle to capture.

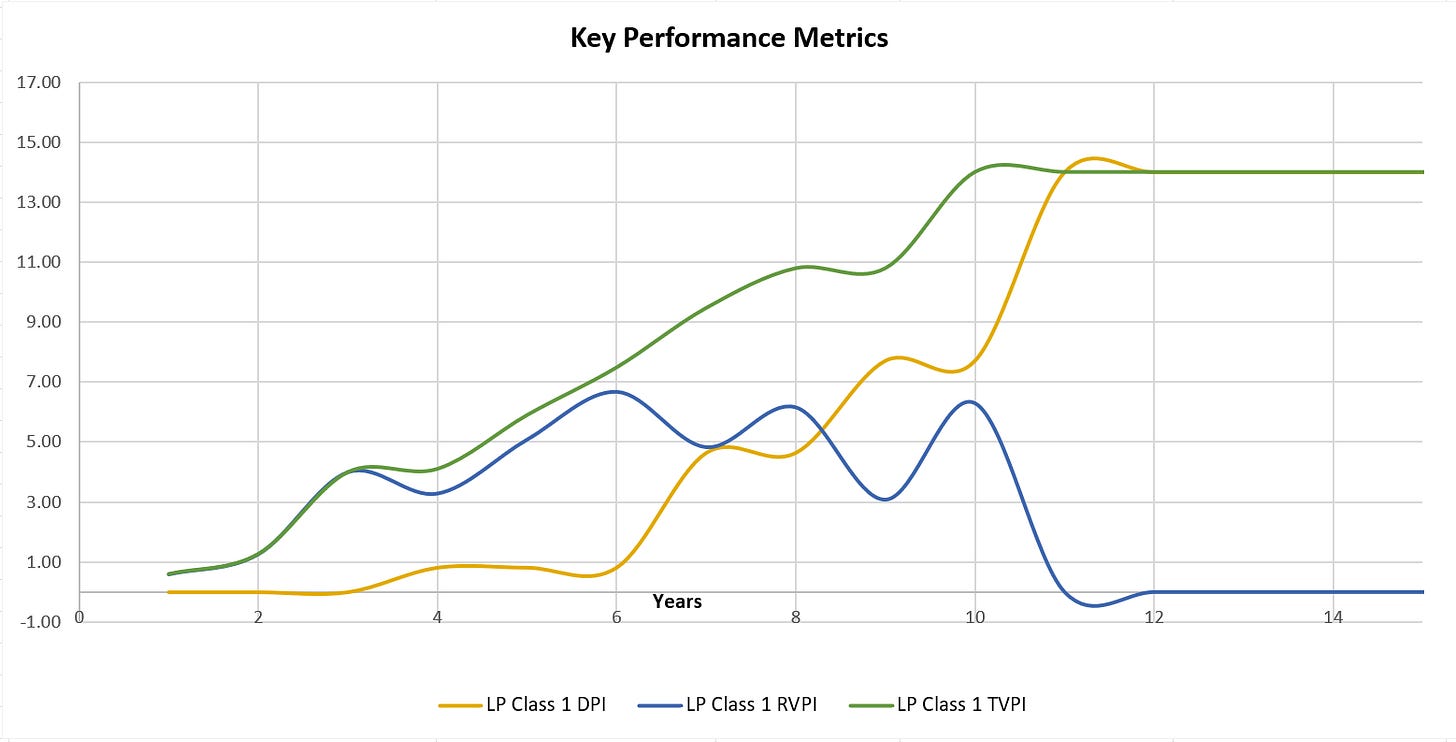

Figure 1: Example TVPI/DPI/RVPI of a Venture Studio

A New Analytical Framework

We've developed a comprehensive modeling framework that examines venture studios across multiple dimensions, capturing both operational and financial dynamics. This model represents thousands of hours of research and development, informed by our deep experience in the venture studio ecosystem.

Core Capabilities

Our framework can analyze four distinct paths to value creation:

Venture Capital Focus: Building high-growth technology companies aimed at traditional venture capital pathways

Private Equity/M&A: Creating companies optimized for strategic acquisition

Corporate Builds: Developing ventures aligned with corporate strategic needs

Cash Flow Companies: Building sustainable businesses engineered for consistent profit distribution

For each pathway, we can model:

Customized ownership positions and timing

Early exit scenarios and follow-on investment strategies

Operational costs linked directly to build pace and team structure

Fund structure variations (Permanent Holdco, Independent Holdco, Traditional Fund, Dual Entity)

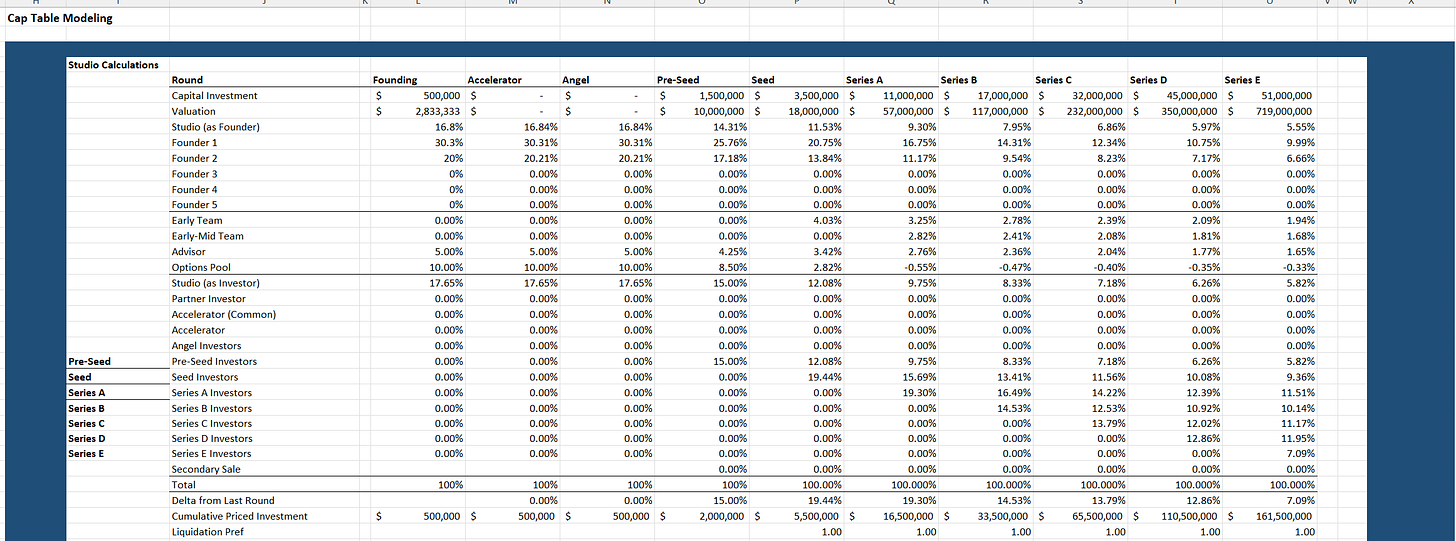

Figure 2: Sample Cap Table Evolution