The Eight-Driver Framework for Venture Studio Deal Structures

Finding the right ownership balance

Venture studios face one of the most consequential yet poorly understood challenges in modern entrepreneurship: determining the right deal structure for their portfolio companies. Unlike traditional venture capital, where investors evaluate external opportunities at fixed valuations, venture studios control the entire company creation process—from initial ideation through market validation to team assembly and initial funding. This control creates both unprecedented opportunity and unique complexity in structuring equitable arrangements.

The stakes could not be higher. Deal structures fundamentally shape every relationship within the venture studio ecosystem. They determine whether studios can attract top entrepreneurial talent, secure follow-on investment, satisfy their own investors, and ultimately deliver sustainable returns. The category is now managing on the order of tens of billions of dollars globally, and multiple analyses show that company creators have delivered meaningfully higher average net IRRs than traditional venture funds over comparable windows. Yet the industry still lacks a standardized approach for one of its most critical decisions: how to architect equitable, workable structures for spinouts.

This absence of clear standards creates friction throughout the ecosystem. Studios struggle to justify their ownership positions and compensation packages to potential entrepreneurs and investors. Entrepreneurs cannot easily evaluate competing studio opportunities without transparent benchmarks. Follow-on investors lack frameworks to assess whether studio deal arrangements enhance or hinder portfolio company performance. The result is inefficient capital allocation, missed opportunities, and suboptimal outcomes for all parties.

The fundamental challenge lies in a widespread search for universal answers to inherently situational questions. Industry practitioners frequently seek single equity ranges or formulaic approaches that can be applied across all studios and situations. But venture studios operate in vastly different contexts—from deep tech commercialization to consumer product development, from Silicon Valley to emerging markets, from breakthrough innovation to proven business model execution. These contextual differences demand different deal structure approaches.

This article presents a practical framework built from first principles and informed by an extensive global dataset of studios. Its goal is not to prescribe a formula, but to improve decision quality—helping studios, entrepreneurs, and investors articulate why a given structure fits a specific context.

Context First: Model Variation and Anti‑Anchoring

Before examining the framework that drives appropriate deal structures, it's essential to address a fundamental challenge that pervades venture studio discussions: the tendency to seek universal answers from inherently diverse examples. The venture studio ecosystem features remarkable variation in operational models, strategic focus, and market positioning, yet practitioners frequently attempt to extract generalizable lessons from specific cases without accounting for critical contextual differences. This pattern creates misleading anchors that can lead studios astray when designing their own structures. Understanding why context must precede convention represents the foundation for sophisticated deal structure thinking.

Context matters more than convention. The right structure is situational, a product of sector economics, target follow‑on markets, team strategy, and the studio’s depth of involvement. Studios span distinct archetypes—formation studios, commercialization studios, and early‑stage incubators—often blended within a single platform. Legal‑economic structures also vary (traditional funds, holding companies, dual‑entity and hybrid models). Strong outcomes emerge across this spectrum when design aligns with strategy.

Avoid numeric anchoring. Publishing “market” equity ranges creates false precision. The same headline percentage can be either generous or inadequate depending on: (i) who did what pre‑formation, (ii) risk removed through stage‑gates, (iii) sector capital intensity, (iv) governance design, and (v) the funding pathway you’re explicitly targeting. The only defensible practice is to show your work: narrate why a given distribution aligns with your strategy and these eight drivers. This framework is deliberately non‑prescriptive on numbers.

The Four-Customer Framework

Before examining the drivers of appropriate deal structures, it's essential to understand that every venture studio serves four distinct customers, each with different success criteria:

Studio Investors require returns that justify the higher operational costs and longer timelines inherent in the studio model. Unlike traditional venture capital limited partners, studio investors are funding both company creation activities and direct investments, creating different return expectations and timeline considerations.

Studio Team and the Studio Founders need meaningful participation in the success they create. The intensive, hands-on nature of studio work requires compensation structures that align with the value created through systematic company building rather than traditional fund management.

Entrepreneurs must receive sufficient total compensation—including equity, cash, benefits, and learning opportunities—to remain motivated through the challenges of scaling companies while competing against alternatives like independent founding, joining existing startups, or pursuing traditional employment opportunities.

Follow-On Capital Sources require cap table structures and governance arrangements that meet their specific investment criteria, due diligence requirements, and return thresholds. These vary dramatically between venture capital, private equity, strategic acquirers, and debt financing.

The deal structure must simultaneously satisfy all four customer groups. Structures that favor one group at the expense of others ultimately fail because venture studio success depends on alignment across all stakeholders. This creates the need for sophisticated, situational approaches rather than simplistic formulas.

The Eight Critical Drivers

Successful venture studio deal structures emerge from careful analysis of eight primary drivers that shape the market context in which the studio operates. These drivers are not sequential considerations but interconnected factors that must be evaluated holistically. Treat each driver as a design lever. Pulling one changes the load on the others. A sound structure emerges from balancing all eight.

1. Target Follow-On Capital Source

The intended source of follow-on capital establishes the fundamental constraints within which all deal structure decisions must operate. Different capital sources have distinct expectations for founder ownership, studio involvement, and cap table structure that must be accommodated from the initial deal design.

Venture capital markets create specific parameters around founder equity retention and studio ownership that vary significantly by funding stage. Pre-seed investors typically have different tolerance levels for studio ownership than seed investors, who in turn differ from Series A investors in their expectations for founding team motivation and control. The critical insight is that studios must identify their specific target investors—not just the general category—and design initial structures that will meet those specific investors' due diligence criteria and investment thresholds.

Private equity and strategic acquisition targets fundamentally alter the deal structure calculus. Since these exits typically involve majority or complete ownership changes, the emphasis shifts from ongoing founder motivation through multiple funding rounds to demonstrating operational efficiency and strategic value. Studios building toward these exit paths can justify different initial ownership and compensation structures when the business model and timeline support this strategic direction.

Debt financing strategies reduce the dependency on equity-based follow-on capital entirely. Studios building companies designed for debt financing must structure initial deals to support the cash flow generation and operational metrics that lenders require, which may enable different approaches to equity allocation and founder compensation.

The key principle is precise identification: studios must know specifically which investors they are designing for and their expectations, not just general categories. This specificity allows for verification that proposed deal structures will actually work when tested against real investor requirements.

2. Entrepreneur Profile

Entrepreneurs evaluate studio partnerships as part of their broader career and compensation optimization, considering the complete value proposition rather than equity alone. The total deal structure must compete effectively against the entrepreneur's best alternatives across multiple dimensions.

Compensation expectations vary dramatically based on the entrepreneur's career stage and alternatives. Experienced executives often prioritize cash compensation and benefits that replace corporate structures they're leaving behind and their personal financial needs supporting a mortgage, health insurance, and family, while early-career entrepreneurs may emphasize learning opportunities and equity upside over immediate cash needs. The deal structure must reflect these different priority sets to attract the intended entrepreneur profile.

Risk tolerance influences how entrepreneurs value different components of studio deals. Those with significant personal financial obligations may require higher cash compensation or more predictable equity structures, while entrepreneurs with financial flexibility may accept more equity-heavy, higher-risk arrangements. Studios must design compensation packages that align with their target entrepreneurs' risk capacity.

Alternative opportunities create the competitive baseline that studio deals must exceed. Entrepreneurs considering multiple studio opportunities, independent founding, or traditional employment will evaluate the total value proposition—including compensation, equity potential, support quality, learning opportunities, and career advancement prospects. Studios must understand and compete against these specific alternatives rather than assuming entrepreneurs will accept below-market arrangements.

The geographic context significantly influences entrepreneur expectations and alternatives. Silicon Valley entrepreneurs have different opportunity sets and compensation expectations than those in emerging startup ecosystems, requiring studios to calibrate their deal structures to local talent markets and competitive realities.

3. Studio Investor Expectations

Studio investor return requirements create direct pressure on deal structure decisions through their impact on required ownership levels, timeline expectations, and portfolio construction approaches that drive returns. These expectations must be balanced against the other drivers to create sustainable arrangements.

Return thresholds directly influence the ownership levels studios must achieve across their portfolios to deliver investor expectations. Higher return requirements necessitate either higher ownership percentages, more selective company creation focused on larger outcome potential, or delivering a higher success rate. Higher ownerships creates tension with entrepreneur retention and follow-on investor acceptance that must be managed through sophisticated deal design.

Portfolio diversification requirements may influence individual company deal structures when investors expect studios to create companies across different risk profiles, market segments, or development timelines. This portfolio-level thinking can create flexibility for deal structure optimization at the individual company level.

4. Industry Norms

Industry context establishes baseline expectations for deal structures through established practices, talent competition patterns, and follow-on investor familiarity. Different sectors have evolved distinct approaches to founder compensation, equity allocation, and governance that directly influence both entrepreneur expectations and investor acceptance.

Software and technology companies typically feature founder-friendly norms developed around capital-efficient business models and rapid validation cycles. Biotech and healthcare industries have evolved different standards reflecting longer development timelines and regulatory requirements. Consumer products, fintech, and industrial sectors each carry distinct compensation and equity traditions that affect both talent recruitment and follow-on investment processes.

Deviating from industry norms requires clear strategic justification and may create friction in talent recruitment or follow-on fundraising. Studios operating across multiple industries must navigate these varying expectations while maintaining internal consistency in their approach.

5. Capital Intensity

The amount of capital required before meaningful validation shapes appropriate deal structures by influencing risk distribution, studio investment requirements, and entrepreneur alternatives. Capital intensity represents one of the most significant drivers of deal structure variation across different business models.

Low capital intensity businesses—typically software and digital services—enable rapid, inexpensive market testing that reduces early-stage risk and supports higher founder equity retention. Studios can validate concepts with minimal investment, creating less justification for significant ownership claims and more flexibility in founder compensation structures.

High capital intensity businesses—such as biotech, manufacturing, or infrastructure—require substantial upfront investment before achieving meaningful validation milestones. Studios assuming this capital risk may warrant different ownership structures that reflect their financial contribution and risk assumption. The deal structure must account for both the capital deployed and the risk mitigation provided through studio resources and expertise.

The timing of capital requirements also influences deal structures. Businesses requiring immediate significant investment create different risk profiles than those enabling staged capital deployment aligned with validation milestones. Studios can design deal structures that reflect these different capital timing patterns and associated risk profiles.

6. Regional Ecosystem

Geographic context shapes deal structure expectations through regional investment cultures, competitive intensities, resource availability, and regulatory environments. Studios must adapt their structures to regional realities while maintaining consistency with their operational model and investor requirements.

Investment culture varies significantly across regions, with some markets favoring founder-friendly structures while others accept higher studio ownership as standard practice. These cultural differences influence both entrepreneur expectations and follow-on investor acceptance of various deal structures. Studios must understand and adapt to local investment culture while ensuring their structures remain compatible with their target follow-on capital sources.

7. Studio's Founder Role

The specific role studios play in company creation determines the appropriate deal structure based on risk assumed, value contributed, and alternatives displaced. Different roles justify different ownership levels and compensation arrangements based on the actual contribution and risk profile.

When studios function as the primary founder—originating ideas, conducting validation, building initial products, and recruiting management teams—they assume the full founder risk and provide the foundational value typically contributed by independent entrepreneurs. This role may justify significant ownership and control arrangements that reflect the substitution for traditional founder contribution.

Co-founder arrangements involve studios partnering with entrepreneurs from the earliest stages, sharing ideation, validation, and building responsibilities. These collaborative relationships typically warrant more balanced deal structures that reflect shared contribution and risk while ensuring both parties remain motivated throughout the company development process.

Studios joining existing early-stage ventures in late co-founder roles provide acceleration and resources to teams that have already assumed initial founder risk and created preliminary value. These arrangements typically warrant ownership and compensation structures that reflect the studio's incremental contribution rather than foundational role.

When studios acquire or license existing assets to serve as foundations for new ventures, they assume different risk profiles and provide different value than pure startup creation. These refounder arrangements may justify ownership structures based on asset acquisition costs and transformation risks rather than traditional founder contribution metrics.

The critical principle is alignment between claimed role and actual contribution. Studios that claim founder-level ownership while providing barely part time co-founder-level contribution create misaligned expectations and unsustainable arrangements.

8. Studio Role Execution

The studio's actual delivery against promised value creation represents the accountability mechanism that validates or invalidates deal structure arrangements. The degree to which studios fully embody the founder role they are playing—whether they provide full-time or part-time engagement, comprehensive versus limited support—determines whether studios truly substitute for great co-founders or provide supplementary value.

Studios that consistently deliver high-quality support across multiple dimensions—product development, talent recruitment, market validation, operational infrastructure—for sustained periods can justify deal structures that reflect their actual value contribution and risk mitigation. Those that provide limited support should calibrate their deal structures to reflect their actual capabilities rather than claiming equity based on theoretical full founder level support they don't actually provide.

Studios that fail to deliver promised support while maintaining founder-level equity create entrepreneur resentment and follow-on investor skepticism that damages long-term success prospects. The quality of delivery does matter and serves as a critical factor that influences appropriate equity allocations. High quality is the expected baseline. As quality reduces and support becomes more limited very different deal structures are appropriate.

Track record provides the primary evidence for execution assessment. Studios with demonstrated success in company creation, talent development, and value generation can justify deal structures based on proven capabilities, while newer studios may need to earn credibility through more entrepreneur-friendly initial arrangements.

Strategic Integration Across Drivers

These eight drivers do not operate independently but create complex interactions that shape appropriate deal structures. It’s best to consider the drivers as influencers of the acceptable ownership range rather than prescribing fixed percentages.

Studio investors, staff, and studio founders want the studio ownership maximized to ensure adequate returns and meaningful participation. Entrepreneurs want it minimized to preserve their motivation and upside. Follow-on capital requirements depend on the situation, but regional norms, the execution commitment of the studio, and the founder role it plays all influence what a market range starts to look like. The interplay between target follow-on capital and industry norms often creates alignment opportunities, as certain capital sources tend to specialize in industries with compatible expectations. Studios can leverage this alignment to design structures that satisfy both current deal requirements and future funding needs. Regional ecosystem dynamics interact significantly with entrepreneur profile targeting, as different geographic markets attract different entrepreneur types with varying alternatives and expectations. Studios must calibrate their approach to both regional norms and their specific entrepreneur recruitment strategy. Studio role definition must align with execution capabilities to maintain credibility with all stakeholders. Studios claiming founder-level ownership must deliver founder-level value consistently, while those providing more limited support should structure deals accordingly.

The right studio deal structure is a reflection of the studio thesis, capabilities, support provided, and ecosystem. There is no one size fits all answer across the venture studio model.

Building Market-Tested Structures

The framework's ultimate value lies in enabling systematic development and review of deal structures that reflect market realities rather than theoretical optimization. Market testing provides the critical feedback loop for structure refinement and validation.

Entrepreneur recruitment success provides immediate feedback on deal structure competitiveness. Structures that consistently fail to attract target entrepreneurs, or only attract low quality candidates, may require adjustment regardless of their theoretical advantages. The market for entrepreneurial talent ultimately determines acceptable arrangements.

Follow-on investment success validates whether deal structures create investable companies with appropriate cap tables and governance arrangements. Structures that create follow-on funding challenges require revision even if they appear optimal from the studio's perspective.

Studio investor validation ensures that deal structures support financial models that drive acceptable returns. Studios must demonstrate that their ownership positions, when aggregated across the portfolio and adjusted for expected success rates, will deliver the returns that justify investors' capital commitments and the higher operational costs inherent in the studio model.

Studio team and founder satisfaction confirms that deal structures provide meaningful participation relative to the value created and risks assumed. Staff and studio founders need to see that their intensive company-building efforts translate into appropriate equity participation that reflects their systematic value creation rather than traditional fund management fees.

This is the feedback loop—test with all four customers. As the studio strategy evolves, test again. Focus testing in your industry and region to anchor to the norms that matter. However, success with any single customer group does not validate the overall structure. All four must align with the deal structure, or the entire model risks failure. Studios that satisfy entrepreneurs and follow-on investors while disappointing their own investors often find themselves unable to raise subsequent funds, effectively ending their ability to continue operations. The interdependence of these relationships demands structures that work for everyone simultaneously.

The Fractal Case Study: When Driver Constraints Conflict

The recent challenges faced by Fractal Software provide concrete illustration of how driver misalignment creates unsustainable deal structures. The studio's operational difficulties, documented in Business Insider's coverage of founder complaints about being "blacklisted" by investors, demonstrate the cascading effects when multiple drivers create conflicting constraints simultaneously as explored in Fractal: A Case Study in Studio Design.

Fractal's structure violated several critical driver relationships. The studio targeted Series A venture investors after only 12 months of company development while operating in Silicon Valley's founder-friendly ecosystem—a combination that ignored both follow-on capital timeline expectations and regional norms. Traditional venture studio requires over 24 months on average to secure a Series A for their portfolio companies, half that of traditional startups. Yet Fractal's thesis demanded four times faster development cycles than industry standards and twice the pace of the average venture studio.

The entrepreneur profile and studio execution drivers created additional constraint conflicts. With founders reportedly receiving approximately 15% equity each while the studio provided roughly two full-time employees worth of support over 12 months, the value proposition became uncompetitive against independent founding alternatives. The studio claimed founder-level ownership while delivering part-time co-founder level engagement, creating the misaligned expectations that ultimately generated entrepreneur resentment.

Industry norms and follow-on capital sources produced the final constraint violation. Fractal's operational execution - high-speed company creation with limited support per company - violated venture capital expectations around founder ownership and development timelines. The studio's approach might have succeeded with private equity or strategic acquirers as target follow-on capital, but venture capital requires founder motivation through multiple rounds and longer validation periods that Fractal's model couldn't accommodate.

These driver conflicts illustrate how deal structures must satisfy constraint combinations rather than individual variables. Fractal's approach might have succeeded with different driver alignment—targeting debt financing instead of venture capital, operating in regions with different founder expectations, extending development timelines to match investor requirements, or providing actual founder-level support to justify equity claims. The framework's value lies in identifying these constraint incompatibilities before they become operational failures that damage all four customer relationships simultaneously.

From Framework to Formula: Practical Calculation Tools

The eight-driver framework provides sophisticated analytical foundation for deal structure decisions, but practitioners require actionable tools to translate analysis into specific equity arrangements. Converting the framework's interconnected variables into mathematical relationships enables systematic evaluation and consistent application across different venture studio contexts.

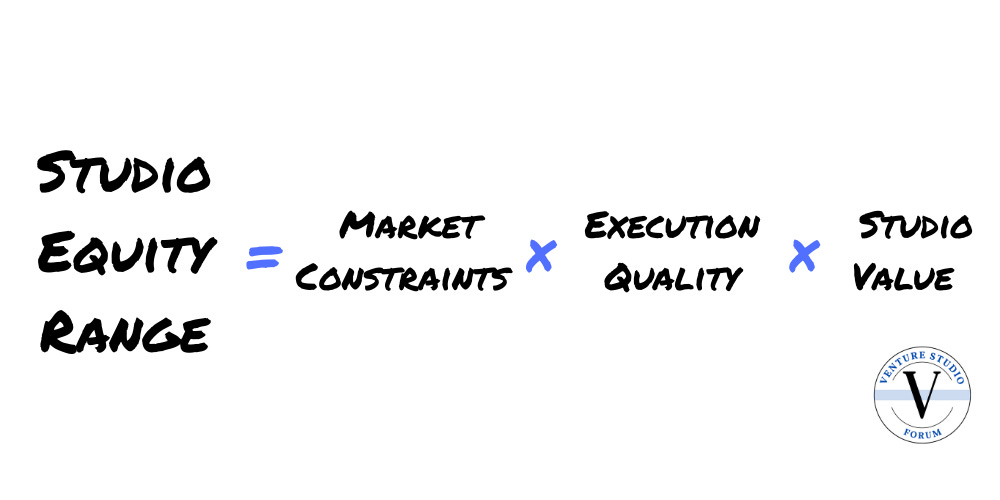

The formulation approach recognizes that deal structures emerge from the interplay between three fundamental forces: market constraints that establish boundaries within which arrangements must operate, studio value creation that justifies ownership claims, and execution quality that validates whether claimed value actually materializes. These forces operate simultaneously rather than sequentially, creating a constraint optimization problem rather than a simple calculation.

The Relationship Formula

Studio Equity Range = Market Constraints × Studio Value × Execution Quality

This relationship captures the essential dynamics governing venture studio deal structures. Market constraints establish the boundaries of possibility—what follow-on investors will accept, what industry norms permit, and what regional ecosystems tolerate. Studio value represents the justification for ownership claims based on capital deployed, risk assumed, and role contribution. Execution quality serves as the credibility multiplier that determines whether theoretical value claims translate into actual stakeholder acceptance.

The multiplicative relationship reflects the interdependent nature of these forces. Superior execution cannot overcome fundamental market constraints, just as strong market positioning cannot justify ownership claims without commensurate value creation. Studios must achieve minimum thresholds across all three dimensions to create viable structures.

The Calculation Formulas

While the relationship formula provides conceptual guidance, practitioners require specific calculations to establish equity ranges for particular situations. The framework translates into two boundary calculations that define the viable range for studio ownership.

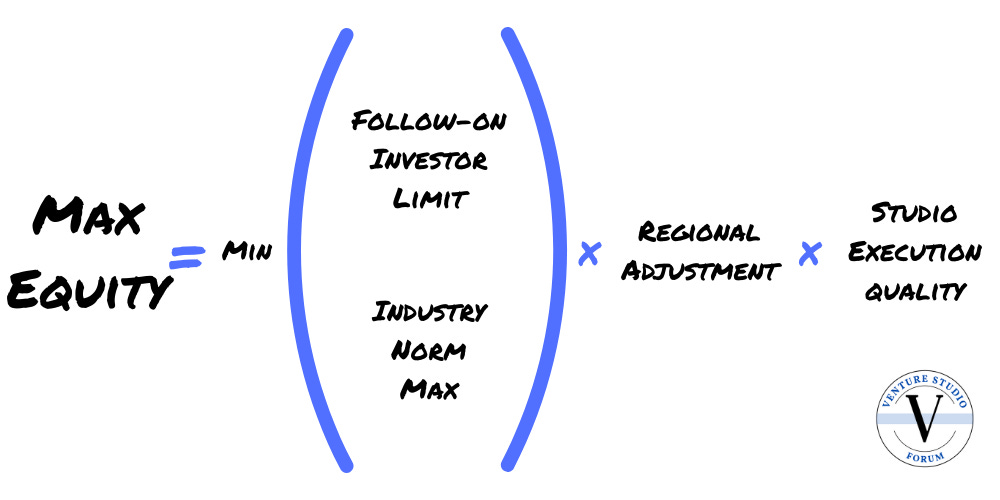

Maximum Studio Equity

Maximum Studio % = MIN(Follow-On Investor Limit, Industry Norm Max) × Regional Adjustment × Studio Execution Quality

The maximum formula establishes the upper boundary of viable studio ownership by identifying the most restrictive external constraint and adjusting for regional and execution factors. Follow-on investor limits represent hard constraints based on investor requirements for founder motivation and control. Industry norm maximums reflect established practices that influence both entrepreneur expectations and investor acceptance.

The regional adjustment factor accounts for geographic variations in investment culture and competitive intensity. Founder-friendly ecosystems like Silicon Valley typically require lower studio ownership to attract entrepreneurial talent, while emerging markets may accept higher studio positions as standard practice. Studio execution quality serves as a multiplier that can expand the acceptable range when track record demonstrates consistent value creation.

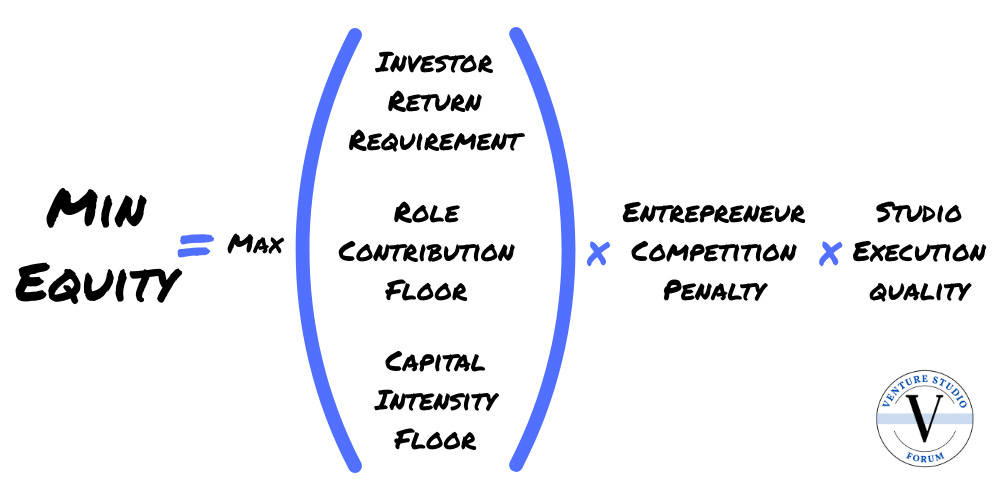

Minimum Studio Equity

Minimum Studio % = MAX(Investor Return Requirement, Capital Intensity Floor, Role Contribution Floor) × Entrepreneur Competition Penalty × Studio Execution Quality

The minimum formula establishes the lower boundary by identifying the highest internal requirement and adjusting for competitive and execution realities. Investor return requirements create portfolio-level constraints based on required returns, expected success rates, and average return created. Capital intensity floors reflect the ownership justified by significant financial investment before meaningful validation. Role contribution floors vary based on whether studios function as primary founders, co-founders, late-cofounders, or refounders.

Entrepreneur competition penalty accounts for talent market dynamics that may require below-optimal studio ownership to secure target entrepreneurs. Highly competitive markets for specific skill sets can force studios to accept lower ownership to attract necessary talent. Studio execution quality affects the minimum by determining whether studios can credibly claim ownership levels based on promised value delivery.

The Viable Range Test

Viable Range = Minimum Studio % - Maximum Studio %

Deal structures become possible only when the maximum exceeds the minimum, creating positive viable range. Negative ranges indicate that market constraints prevent studios from achieving ownership levels required to satisfy their internal requirements. Zero ranges suggest that deals are theoretically possible but offer no flexibility for negotiation or unexpected circumstances.

Studios facing negative viable ranges must address the fundamental constraint mismatch before pursuing specific opportunities. This might involve targeting different follow-on capital sources with higher tolerance for studio ownership, reducing investor return requirements by changing timelines or focusing on different risk profiles, or improving execution capabilities to expand acceptable ownership ranges.

Application Methodology

Systematic application requires studios to quantify each variable based on their specific context rather than applying generic assumptions. Follow-on investor limits should reflect actual discussions with target investors rather than general market research. Industry norm ranges should focus on relevant subsectors and business models rather than broad technology categories. Regional adjustments should account for local talent competition and investment culture rather than geographic stereotypes.

Capital intensity floors require realistic assessment of financial requirements before meaningful validation milestones. Role contribution floors should reflect actual rather than claimed founder responsibilities. Execution quality multipliers should be based on demonstrated track record rather than theoretical capabilities.

The formulas serve as analytical tools rather than negotiation positions. Studios should use the viable range to understand the boundaries of possibility and design specific arrangements that optimize across all stakeholder interests within those boundaries. The goal is sustainable structures that maintain alignment across multiple funding rounds rather than maximizing studio ownership in initial arrangements.

Market testing remains essential for validation. Formulas provide analytical foundation, but entrepreneur recruitment success, follow-on investment reception, and investor satisfaction ultimately determine whether structures work in practice. Studios should treat calculated ranges as hypotheses to be tested rather than definitive answers to be implemented.

Venture Studio Deal Structure Worksheet

While these formulas provide conceptual understanding, translating the eight-driver framework into defensible equity structures requires systematic analysis of your specific constraints and market position.

The Venture Studio Deal Structure Worksheet operationalizes this framework through a step-by-step methodology that guides studios through driver analysis, variable quantification, range calculation, and stakeholder validation. Rather than relying on venture studio averages that may not reflect your context, the worksheet enables you to develop equity structures based on your actual follow-on capital targets, entrepreneur alternatives, investor requirements, and execution capabilities. The tool includes the mathematical formulas from the framework along with validation protocols to test whether your calculated ranges work for all four customer groups before implementation.

Get immediate access to the Venture Studio Deal Structure Worksheet (plus the complete archive of practitioner resources) with your free Venture Studio Forum membership.

Toward Contextual Excellence

The venture studio model's continued evolution and institutional acceptance depend on bringing sophisticated, contextual thinking to deal structure decisions. Rather than seeking universal formulas for inherently situational decisions, the industry must embrace frameworks that enable sophisticated, context-specific optimization. The eight-driver framework provides the analytical foundation for this more mature approach to one of venture studios' most critical challenges.

Ongoing refinement based on market feedback, changing competitive conditions, and evolving stakeholder expectations is common. Market conditions change and studios mature. Studios that view deal structures as dynamic, testable hypotheses rather than fixed policies will maintain the flexibility necessary to optimize performance across changing market conditions.

The Eight‑Driver Framework is a way to reason from context to structure. There is no universal answer, only coherent design. The right question is not “What percentage should the studio hold?” but “Given our strategy, sector, and next‑round buyer, what arrangement creates the best chance of success for investors, team, founders, and follow‑on capital?” When each of the four customers would willingly choose the arrangement again, you’ve likely found the balance point.

The eight-drive framework was established by Matthew Burris and has been tested and refined through direct work with studio founders, operators, and investors across multiple markets and sectors. The framework underpins and shapes several of the core insights in the Venture Studio Index, providing systematic analysis of venture studio performance and design patterns. This framework is based on extensive research across 500+ venture studios globally.

About the Author

Matthew Burris serves as the Senior Director of Research at the Venture Studio Forum, where his mission is to transition venture studios from an emerging asset class to an established asset class. In this role, he leads the creation of the rigorous data frameworks and due diligence standards required for institutional adoption.

This research is built upon the proprietary insights Matthew developed as Partner & Head of Insights at the 9Point8 Collective and study of over 500 venture studios globally. By codifying the methodologies from his advisory work with corporate, university, economic development, and private studios, he provides the Forum with the foundational architecture needed to define the industry.

Connect with Matthew on LinkedIn.