The Fatal Flaws in the Venture Studio Model

Navigating Multi-Stakeholder Tensions

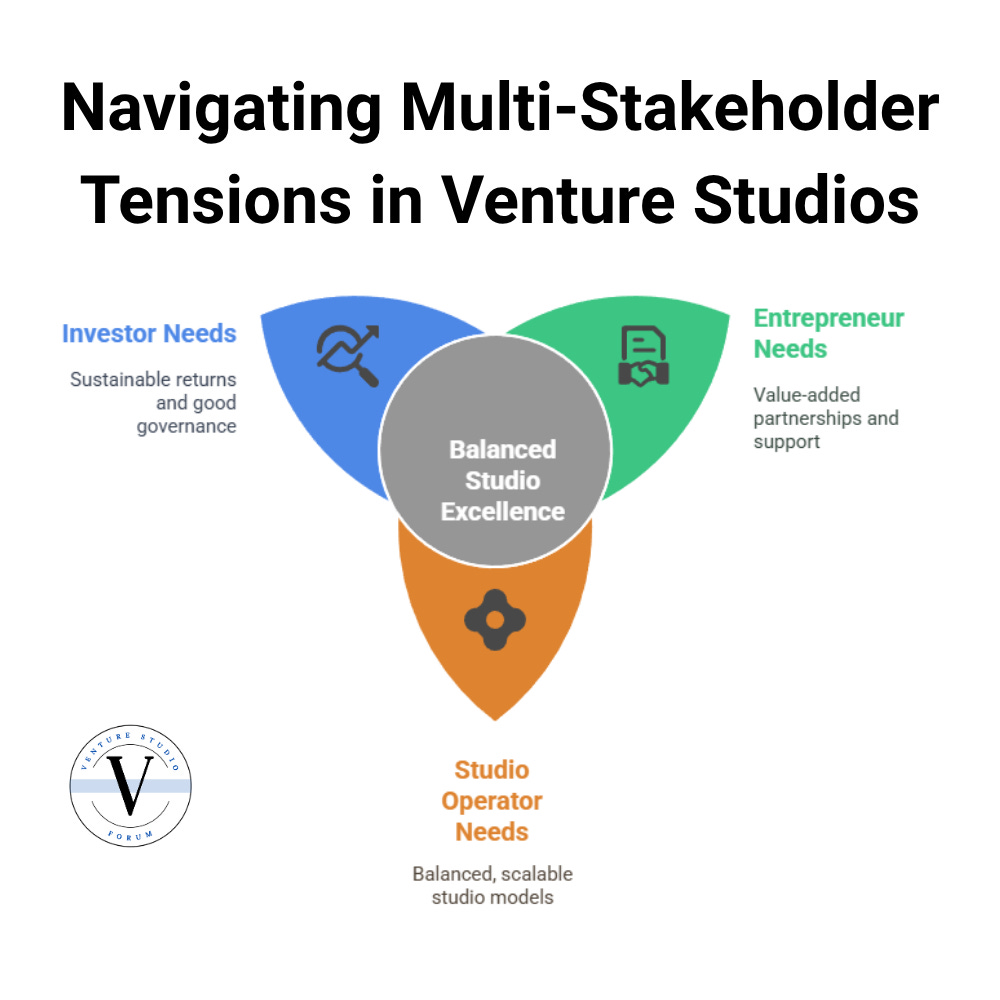

Venture studios have emerged as a compelling innovation in company creation, delivering superior returns through active management and systematic company building. Despite impressive performance metrics—average net IRRs of 60% compared to 33% for top-quartile traditional venture capital—venture studios face fundamental structural vulnerabilities that arise from trying to simultaneously satisfy multiple stakeholders with competing demands. By examining these critical tensions, investors, entrepreneurs, and studio operators can better evaluate, mitigate, and navigate these inherent risks.

Introduction

Venture studios represent the evolution of company creation—combining the entrepreneurial vision, operational expertise, and financial discipline traditionally separated across the startup ecosystem. By integrating these functions, studios have demonstrated measurably superior outcomes compared to traditional venture investing, with portfolio companies reaching Series A in 25 months versus 56 months for conventional startups and achieving success rates of 60% versus 25% for traditional company building.

Yet beneath these impressive metrics lies a complex system of interdependencies that creates inherent vulnerabilities in the model. These are not merely operational challenges but fundamental tensions between competing stakeholder needs that can undermine even the most promising studio. Understanding these fatal flaws is essential for investors evaluating studio opportunities, entrepreneurs considering studio partnerships, and studio operators designing sustainable models.

The Four-Stakeholder Tension: The Root of All Fatal Flaws

At the core of the venture studio model is a challenging reality: studios must simultaneously satisfy four distinct stakeholders with a single product offering. Each stakeholder has its own expectations, requirements, and definitions of success:

Studio Investors - Focused on financial returns, capital efficiency, and portfolio performance

Studio Staff & Partners - Seeking challenging work, equity upside, and career stability

Entrepreneurs - Demanding meaningful equity, supportive partnerships, and acceptable deal terms

Follow-on Capital - Requiring attractive ownership structures, promising traction, and experienced management teams

This four-stakeholder dynamic creates a uniquely challenging balancing act. Unlike traditional businesses that can prioritize certain customer segments, venture studios face an existential risk if any single stakeholder walks away. The interdependency is complete—without entrepreneurs, there are no companies; without follow-on capital, there is no path to liquidity; without investors, there is no funding; and without staff, there is no execution capability.

Each fatal flaw in the venture studio model can be understood as a particular manifestation of tension between these stakeholder groups, where satisfying one stakeholder's needs creates friction with another's.

Fatal Flaw #1: The Ownership Paradox

Primary Tension: Studio Investors ↔ Entrepreneur ↔ Follow-on Capital

The ownership paradox emerges from the fundamental tension between what studio investors require to generate acceptable returns and what follow-on capital expects to see in capitalization structures.

Studio investors rightfully expect significant equity ownership in portfolio companies to justify their early risk and resource deployment. Vault Fund data shows that target ownership ranges from 21% to 43%, largely dependent on structure and funding provided. This level of ownership is necessary to generate the returns needed to justify the studio model and data indicates that studio ownership is within market norms.

Follow-on capital sources, particularly VCs, often express concern that this studio ownership dilutes founder incentives. The conventional wisdom suggests that founders in studio-built companies must end up with less equity than they would in traditionally-built startups, potentially undermining their motivation to build a successful company.

However, a careful analysis of captable dynamics reveals a more nuanced reality. When comparing actual ownership percentages at the individual founder level—rather than collective founding team ownership—the picture changes dramatically.

The key insight is that studios effectively replace one or more co-founders on the captable. In a traditional startup, the founding equity must be divided among multiple individual founders. In contrast, a studio partnership consolidates several founding roles (ideation, validation, early development) into a single entity on the captable. Additionally, studios typically:

Remove the need for multiple early funding sources (accelerators, angels, pre-seed)

Set up options pools on day one with appropriate sizing

Reduce early team dilution by providing resources that would otherwise require equity compensation

These factors together can result in founders actually receiving more individual equity in a studio model than they would following a traditional path with multiple co-founders, despite the studio taking a significant stake.

The Fractal case illustrates what happens when this balance isn't achieved. The venture studio took a majority stake rather than a co-founder-equivalent share, resulting in founders having significantly less equity than they would in traditional models. Follow-on investors perceived this imbalance as a misalignment of incentives and rejected the portfolio companies, effectively "blacklisting" them despite potentially promising business fundamentals.

Mitigation Strategy: Successful studios manage this tension by designing equitable captable structures that position founders with comparable or better individual equity positions than traditional models. Pioneer Square Labs validates potential captable structures with follow-on investors before formation, ensuring downstream funding viability. Others implement dynamic ownership models where studio equity adjusts based on founder contributions and company progress. Most importantly, studios that design founder-favorable equity structures—and effectively communicate these advantages—gain a significant edge in both talent recruitment and follow-on financing.

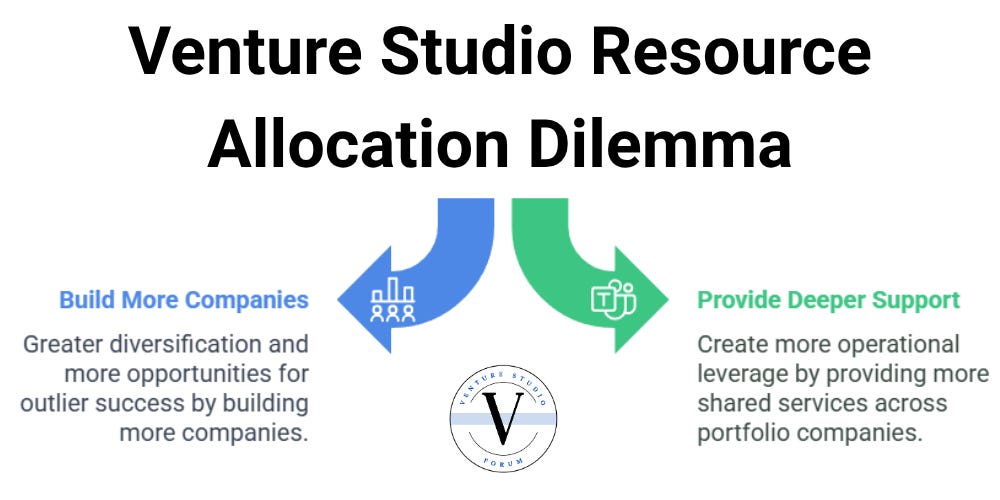

Fatal Flaw #2: The Resource Allocation Dilemma

Primary Tension: Studio Staff ↔ Entrepreneurs

The resource allocation dilemma stems from the tension between entrepreneur expectations for comprehensive support and the finite operational capacity of studio staff.

Entrepreneurs join venture studios with the expectation of receiving significant operational assistance—product development, go-to-market strategy, recruitment, and other critical functions. These expectations are often explicitly set during recruitment, with studios promising "founder-level support" to address key challenges.

Meanwhile, studio staff face practical limitations on their capacity. Each staff member can only support a finite number of portfolio companies effectively, creating tension between portfolio size and support quality. This tension intensifies as studios scale, with each new portfolio company further diluting available resources.

The Fractal case study again provides a cautionary tale. At its peak, the studio was creating approximately one new company per week with a staff of around 100 people. Simple arithmetic suggests each portfolio company received the equivalent of just two full-time employees of support, with founding partners able to provide only a few hours of guidance monthly. This resource constraint left many portfolio companies without the promised support, creating friction with entrepreneurs and undermining company performance.

Mitigation Strategy: Leading studios like High Alpha and eFounders (now Hexa) have addressed this challenge by implementing strict portfolio size constraints, ensuring adequate resources per company. High Alpha, for instance, builds just 4-6 companies annually, allowing them to provide intensive support for 12-18 months. Others, like Atomic, have developed specialized shared service teams that create significant operational leverage across portfolio companies while maintaining clear resource allocation principles.

Fatal Flaw #3: The Timeline Mismatch

Primary Tension: Studio Investors ↔ Follow-on Capital

The timeline mismatch arises from tension between studio investors' expectations for rapid value creation and the realistic timelines required by follow-on capital for proper company development.

Studio investors typically expect to see returns within a defined investment period—often 7-10 years for traditional fund structures. This creates pressure for studios to demonstrate rapid company creation, validation, and value appreciation, pushing portfolio companies toward accelerated fundraising timelines.

However, follow-on capital sources have their own expectations for company maturation. Series A investors typically expect specific milestones around product development, market validation, revenue traction, and team building—all of which require time to achieve properly. Rushing these milestones to satisfy studio investor timelines often results in artificial metrics that don't withstand investor due diligence.

Fractal's operational plan targeted Series A fundraising just 12 months after company formation—less than half the average time (25 months) reported by the Global Startup Studio Network for studio-backed companies. This compressed timeline forced portfolio companies to optimize for short-term metrics that would appeal to Series A investors rather than building sustainable business foundations, ultimately undermining their fundraising efforts.

Mitigation Strategy: Successful studios like OSS Ventures implement milestone-based development rather than time-based targets, allowing companies to progress at the appropriate pace for their market. Others, like Flagship Pioneering, explicitly communicate longer development timelines (7-10+ years) to their investors, creating appropriate expectations from the outset. Some studios have developed hybrid structures that allow for partial liquidity through secondary transactions, satisfying studio investor return expectations while giving portfolio companies appropriate development runways.

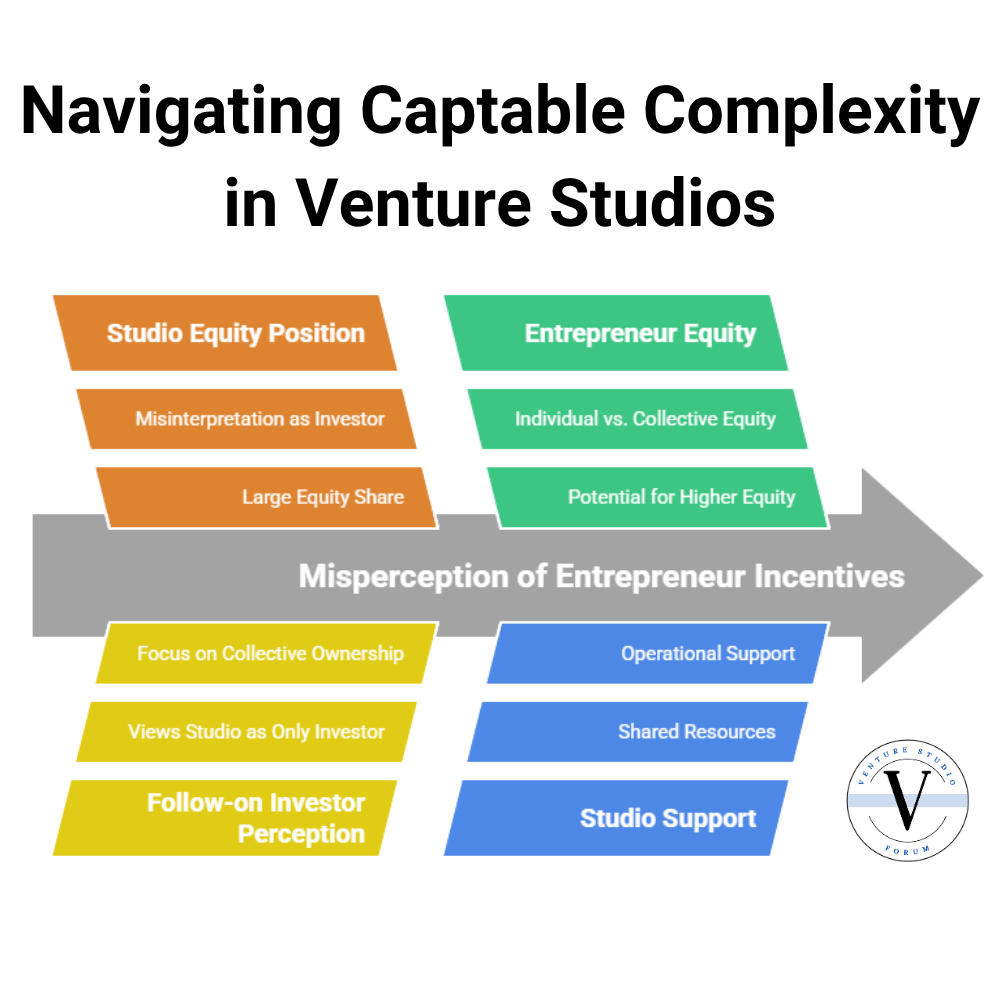

Fatal Flaw #4: The Captable Complexity Trap

Primary Tension: Entrepreneurs ↔ Follow-on Capital

The captable complexity trap emerges from the tension between entrepreneur compensation needs and follow-on capital expectations for clean, incentive-aligned ownership structures.

In traditional startups, captable dynamics are relatively straightforward—founders own the majority of equity at formation, with employees and investors receiving defined allocations. Venture studios introduce perceived complexity to this model, with multiple equity participants before the company spins out: the studio itself (often with both common and preferred holdings), entrepreneurs, early employees, the options pool, and sometimes external investors.

This complexity creates immediate confusion among follow-on investors who often evaluate studio captables using the wrong mental model. Many VCs instinctively look at collective founder ownership—the combined equity of all founding parties—rather than individual founder ownership. When they see the studio holding a large equity position, they count that as an investor position and they immediately conclude that the entrepreneurs must have significantly less equity than they would in a traditional startup, creating what they perceive as a misaligned incentive structure. This is often a red flag that pushed follow on investors away from studio built companies.

Modeling of captable scenarios reveals this perception is often incorrect. When examining individual founder equity positions—which is what actually motivates entrepreneurs—studio partnerships can create superior outcomes. Founders partnering with studios that take a n equal cofounder share or less can end up with more equity than they would have received in traditional multi-founder startups.

This counterintuitive outcome stems from a simple but powerful dynamic: studios often replace one or more cofounders on the captable. No founder makes their long-term decisions based on how much equity their cofounders have—they focus on their own. The best dynamic emerges when studios effectively replace multiple co-founder functions:

Technical co-founder roles through shared development resources

Business co-founder roles through operational support

Early funding sources through initial capital deployment

Early team dilution through shared services

By consolidating these traditionally separate captable participants into a single studio entity, founders can end up with more personal equity despite the studio's significant position.

The challenge arises when follow-on investors fail to understand this dynamic. They see high studio ownership and assume entrepreneur incentives are compromised, when in fact the entrepreneur may be better incentivized than in traditional startups.

Mitigation Strategy: The most successful studios have developed clear education strategies for both entrepreneurs and follow-on investors about captable dynamics. They emphasize individual equity positions rather than collective ownership percentages when communicating with stakeholders. Some studios provide transparent captable comparisons showing how entrepreneur equity in well-designed studio-built companies compares favorably to traditional startups. Others structure their equity allocations to deliberately create improved individual positions for entrepreneurs, making the incentive advantage clear even in cursory analysis. Most importantly, studios that proactively engage follow-on investors in understanding these dynamics before presenting portfolio companies substantially improve fundraising outcomes.

Fatal Flaw #5: The Follow-on Capital Dependency

Primary Tension: Studio Investors ↔ Follow-on Capital

The follow-on capital dependency represents perhaps the most existential vulnerability in the venture studio model—the critical need for external follow-on capital to realize returns from portfolio companies.

For the studio model to work economically, studio investors typically expect companies to secure subsequent financing from external sources. This creates a fundamental dependency that can undermine even well-designed studios. While traditional VCs face similar follow-on financing challenges, the studio model introduces unique dynamics that heighten this vulnerability:

Studio-Specific Captable Structures that follow-on investors may not fully understand or value

Non-Traditional Founding Narratives that don't conform to the "hero founder" stories VCs often prefer

Compressed Development Timelines that may not align with market norms or investor expectations

Systematic Company Creation Approaches that some investors perceive as lacking the passion or conviction of traditional founding journeys

This dependency becomes particularly acute when portfolio companies reach the critical juncture between studio funding and external investment. If follow-on capital sources don't understand or appreciate the studio's value creation, even promising companies face existential risk. The Fractal example illustrates this vulnerability—despite potentially viable businesses, portfolio companies struggled to secure follow-on funding due to investor skepticism about the studio model, particularly their captable structure.

The severity of this dependency varies based on the studio's investment thesis and capital strategy:

Venture-Return Driven Studios targeting high-growth outcomes face the most acute dependency, as they must access institutional venture capital with stringent expectations about ownership, growth, and market size.

Strategic Acquisition Studios face moderate dependency, as they typically need less capital but still require bridge financing or acquisition partners with specific strategic interests.

Revenue-First Studios building sustainable, profitable businesses face lower immediate dependency but often require some form of capital to reach meaningful scale.

This tension creates difficult trade-offs for studio designers. Optimizing solely for studio economics may create captable structures that follow-on investors reject. Conversely, optimizing exclusively for follow-on financing appeal may undermine the studio's own economic viability.

What makes this flaw particularly dangerous is its all-or-nothing nature. If a studio's first cohort of companies fails to secure follow-on capital, the reputational damage can create a self-reinforcing cycle that impacts subsequent companies regardless of their individual merits. This network effect can turn an isolated problem into a systemic failure.

Mitigation Strategy: Successful studios proactively manage this dependency through several interconnected approaches:

Relationship Development - Building strong connections with follow-on investors before portfolio companies need financing, educating them on the studio model, and sometimes inviting them into studio funding rounds or early co-validation

Capital Stacking - Raising both studio funds and traditional venture funds, allowing the studio to lead or participate in follow-on rounds for promising portfolio companies

Strategic Specialization - Developing deep expertise in specific sectors where the studio has exceptional relationships with downstream financing sources

Education Materials - Creating clear documentation that explains studio captable structures and founder incentives, emphasizing how they compare favorably to traditional models

Milestone-Based Development - Designing company development processes to achieve the specific metrics and proof points follow-on investors expect, rather than generic growth metrics

The studios that mitigate this vulnerability most effectively don't see follow-on capital as merely a future need, but as a critical relationship to be cultivated from inception. By building these relationships early and designing their entire operation with follow-on compatibility in mind, they transform what could be a fatal flaw into a strategic advantage.

Fatal Flaw #6: The Resource Bandwidth Strain

Primary Tension: Studio Investors ↔ Studio Staff & Partners ↔ Entrepreneurs ↔ Follow-on Capital

The resource bandwidth strain emerges when studio resources are spread too thin across too many portfolio companies. Studios must provide sufficient support to help portfolio companies reach the metrics and milestones that follow-on capital requires, but limited bandwidth can undermine this capability.

This flaw becomes especially acute in studios with aggressive company creation targets. When the same team is expected to support numerous portfolio companies simultaneously, the quality of support inevitably diminishes. Follow-on investors evaluate companies based on their current traction and future potential—not on the studio's good intentions. When resource constraints prevent portfolio companies from achieving necessary milestones, follow-on capital rejects them regardless of the core business premise.

The strain creates tensions across all four key stakeholders: studio investors expect their capital to be deployed effectively, studio staff become overextended, entrepreneurs don't receive promised support, and follow-on capital finds companies underprepared for investment.

The Fractal example illustrates this dynamic: creating approximately one company per week with a staff of around 100 means each portfolio company received minimal ongoing support. This spread the studio staff too thin to deliver the value-add services needed to prepare companies for follow-on capital success.

Mitigation Strategy: Successful studios implement a reality-based resource allocation model that matches company creation pace with actual capacity. They conduct sanity checks to ensure they can provide the depth and length of support required for quality company building. Leading studios like High Alpha and eFounders explicitly limit their company creation velocity to ensure adequate support for each portfolio company, with clear delineation of which responsibilities fall to the studio versus the entrepreneur team. Some studios also implement portfolio triage systems that periodically evaluate which companies deserve continued resource investment versus which should receive minimal support, creating transparency around these decisions for all stakeholders.

Fatal Flaw #7: The Signal/Noise Problem

Primary Tension: Studio Investors ↔ Studio Team/GPs

The signal/noise problem stems from tension between studio investors' expectations for portfolio diversification and the studio team's need to focus resources on quality execution. Investors typically want a robust portfolio approach to maximize the chances of finding exceptional returns, which can pressure the studio team to prioritize quantity over quality.

When studios feel compelled to continuously launch new companies to demonstrate activity to their investors, they risk creating a high "noise-to-signal" ratio that undermines company quality and ultimate performance. This pressure to maintain a high velocity of company creation can lead to premature validation, inadequate testing, and rushed execution.

This tension goes beyond operational decisions to the core strategic approach of the studio. Is the studio built to produce a high volume of companies with minimal filtering, or is it designed to create fewer, more thoroughly validated ventures? The choice fundamentally shapes resource allocation, team composition, and investor expectations.

Mitigation Strategy: Leading studios address this challenge by embedding investment-quality due diligence across the entire company building process, from initial ideation through spin-out. Rather than treating validation as a single milestone, they implement rigorous quality gates at each development stage. Studios like OSS Ventures and Atomic establish clear quantitative thresholds that ideas must meet before advancing, creating objective criteria that help balance investor expectations for portfolio breadth with the need for quality depth. The most successful studios also educate their investors upfront about their strategic approach to idea generation and validation, establishing alignment on quality-versus-quantity tradeoffs before capital is committed.

Fatal Flaw #8: The Expertise Mismatch

Primary Tension: Studio Staff & Partners ↔ Entrepreneurs

The expertise mismatch flaw occurs when there's a gap between the expertise that entrepreneurs need and what the studio actually provides. Unlike the generalist approach that many assume, studios typically develop specialized capabilities tailored to their thesis, strategy, and target markets. However, this specialization still requires finding entrepreneurs whose needs and capabilities align with the studio's specific strategy.

This creates a complex matching challenge across entrepreneur profiles that range from first-time founders to serial entrepreneurs to seasoned corporate executives transitioning to entrepreneurship. Each brings different experience levels, skill gaps, and support needs that must align with the studio's capabilities.

The fundamental question becomes two-fold: Does the studio provide the specific support that the entrepreneur requires? And does the entrepreneur possess the skills needed to execute on the types of opportunities the studio pursues according to its thesis? When either alignment is missing, the partnership can fail despite good intentions on both sides.

Mitigation Strategy: Successful studios develop explicit frameworks for assessing entrepreneur-studio fit before formalizing partnerships. Science Inc. and Atomic have created detailed entrepreneur evaluation systems that assess not just general capability but specific alignment with the studio's support model. Other studios like PSL and Idealab maintain diverse support capabilities that can flex to accommodate different entrepreneur profiles, while explicitly declining partnerships where their expertise doesn't match founder needs. Many leading studios also implement trial periods or collaborative projects before full commitment, allowing both sides to evaluate fit before significant resources are invested. Most importantly, studios that excel at this challenge are transparent about their own capabilities and limitations, setting clear expectations with entrepreneurs about what support they will and won't provide.

Fatal Flaw #9: The Governance Complexity Challenge

Primary Tension: Studio Investors ↔ Studio Staff & Partners ↔ Entrepreneurs

The governance complexity challenge reflects the unique three-way tension in venture studio governance. While traditional startup governance involves balancing founder and investor interests, studio governance must simultaneously address:

Studio investors' expectations for portfolio performance and capital allocation decisions

Studio staff's operational decisions about resource deployment across portfolio companies

Entrepreneurs' needs for company-specific support and strategic guidance

This three-way governance challenge creates potential conflicts of interest that are more complex than traditional startup governance. Studio investors face a unique concern not present in traditional venture funds: studios not only decide where capital is invested (into which companies) but also where it is spent (inside portfolio companies, and in studio operations, overhead, shared resources). This spending authority creates additional governance complexity and potential principal-agent problems.

The challenge is most pronounced during difficult allocation decisions: pulling resources from a struggling but potentially viable company to support a higher-performing one creates governance conflicts that wouldn't exist in traditional venture models where investors maintain clearer separation between governance and operations.

Mitigation Strategy: The most successful studios implement multi-level governance structures with clear decision rights and transparency mechanisms. Some separate investment decisions from operational resource allocation through distinct committees with different stakeholder representation. Others create formal "resource allocation formulas" that provide objective criteria for supporting portfolio companies at different stages. The best studios also implement transparent reporting mechanisms that give all stakeholders visibility into how resources are being deployed, with clear metrics tracking both investment performance and operational spending. Studios like Pioneer Square Labs and Atomic have also adopted hybrid structures where some resources are dedicated to specific portfolio companies while others remain pooled, creating clearer accountability while maintaining flexibility.

Navigating Multi-Stakeholder Tensions Successfully

These fatal flaws all share a common root: the inherent tension between competing stakeholder needs in the venture studio model. Understanding these tensions is essential for all participants in the venture studio ecosystem:

For investors, these tensions provide a framework for evaluating studio investments beyond simple return metrics. By examining how studios manage competing stakeholder needs, investors can better assess the sustainability of different studio models and identify those most likely to deliver consistent returns.

For entrepreneurs, understanding these tensions helps in evaluating potential studio partnerships. By examining how studios balance different stakeholder requirements, entrepreneurs can identify which studios genuinely add value versus those likely to create downstream challenges.

For studio operators, explicitly addressing these tensions is crucial for long-term success. The most successful studios don't simply ignore these conflicts but design their models to specifically balance competing stakeholder needs.

Structural Variations and Contextual Nuance

It's important to note that venture studios are not monolithic in their approach. Different studio models face these stakeholder tensions to varying degrees based on their risk profile and formation approach. The Venture Studio Category Matrix, a classification framework that maps studios across their risk profile (from cash-flow focused to breakthrough innovation) and formation role (from founder to refounder), provides essential context for evaluating these tensions.

Deep-tech founder studios like Flagship Pioneering face different follow-on capital tensions than cash-flow focused refounder studios like Tiny Capital. Similarly, corporate-backed studios have different resource allocation dynamics than independent studios funded by traditional limited partners.

These structural variations mean that while all studios face the same fundamental stakeholder tensions, the specific manifestations and potential mitigations vary widely across the ecosystem. The most successful studios understand their specific model's vulnerabilities and design deliberate strategies to address them.

Conclusion: Stakeholder Alignment as a Competitive Advantage

Despite these inherent tensions, venture studios represent one of the most promising innovations in company creation. By delivering systematically better outcomes through active management, quality control, and operational expertise, studios have demonstrated impressive potential to transform early-stage company building.

The difference between success and failure often lies not in avoiding these tensions altogether—which is impossible—but in deliberately designing studio models that align stakeholder interests. By understanding the competing needs of studio investors, staff, entrepreneurs, and follow-on capital, studios can develop frameworks that create mutual benefit rather than zero-sum conflicts.

As the venture studio model continues to evolve, those that explicitly address these stakeholder tensions will be best positioned to deliver consistent, long-term performance—turning these structural challenges from potentially fatal flaws into sources of competitive advantage.

This article is part of a series of 10 articles formalizing and defining venture studios as an asset class. Together this articles form the foundational definitions of the venture studio model and provide a framework for comprehensive evaluation.

About the Author

Matthew Burris serves as the Senior Director of Research at the Venture Studio Forum, where his mission is to transition venture studios from an emerging asset class to an established asset class. In this role, he leads the creation of the rigorous data frameworks and due diligence standards required for institutional adoption.

This research is built upon the proprietary insights Matthew developed as Partner & Head of Insights at the 9Point8 Collective. By codifying the methodologies from his advisory work with corporate, university, economic development, and private studios, he provides the Forum with the foundational architecture needed to define the industry.

Connect with Matthew on LinkedIn.

Great article Matthew. I’d value more insights from you on the Flaw: Studio Resource Allocation. I’ve been thinking about a mitigation step for this that integrates the following process upon newco launch:

1) Pre-Launch Resource Needs Assessment - after the studio and founding team have validated the Newco, conducting a resource needs assessment with establish the talent needs for Newco.

2) Budget & Head-Count Plan - based on the resource needs assessment, the studio and founding team should create a 12 month budget and headcount plan.

3) MSA between the Studio and Newco - Similar to an employment agreement with a cofounder, the studio should make a service agreement with the founding team, so it is clear what resources Newco will receive (perhaps tying this to earning equity or compensation).

Thoughts?