The Quality-First Revolution

How Venture Studios Are Transforming Company Creation

For decades, early-stage company creation has operated under a high-risk, high-variance model that embraces failure as an inevitable part of the process. The traditional venture capital approach funds numerous startups with the expectation that most will fail and only a small percentage will yield outsized returns. This is known as the "power law" distribution that has defined the industry.

But what if this high failure rate isn't inevitable, but rather the result of a systematic lack of quality control in company creation?

Venture studios have emerged as a fundamentally different approach to building companies—one that prioritizes systematic quality control throughout the formation process. The focus on active management and quality control stewards returns across the portfolio, rather than depending on finding rare unicorns to offset writeoffs. By implementing rigorous stage-gate processes, specialized expertise, and data-driven validation methods, venture studios are challenging the conventional wisdom that company building must remain a high-failure endeavor.

This issue examines how the venture studio model applies quality control to company creation, derisking the entrepreneurial process and resulting in measurably superior outcomes compared to traditional VC investment approaches. For institutional investors, understanding this quality-first framework offers a compelling alternative to conventional venture capital allocation strategies.

Venture Studios as Startup Private Equity

Venture Studios as Private Equity that Creates Companies

The venture studio model remains misunderstood by many institutional investors, often conflated with accelerators, incubators, or traditional venture funds. This misunderstanding stems from viewing studios primarily as a fund rather than as a company which creates companies.

What truly differentiates venture studios is their control and execution across the entire company creation lifecycle—a distinction that fundamentally changes both the risk profile and expected outcomes of company creation.

A venture studio is defined by its active control across three core functions:

Entrepreneur: Responsible for ideation, validation, and strategic development

Operator: Manages execution, product development, and operational infrastructure

Investor: Deploys capital and manages portfolio financial outcomes.

In many ways, a venture studio operates less like a VC fund and more like an operations-heavy private equity fund that starts companies instead of buying them. This parallel is instructive—both models emphasize rigorous governance, disciplined operational improvements, and careful management of investments. The key difference lies in the starting point: while private equity applies quality control to existing businesses, venture studios build quality into companies from their very inception, systematically derisking the entrepreneurial journey from day one.

Unlike accelerators that provide temporary support to existing startups or traditional VCs that make passive investments across numerous companies, venture studios actively build companies from inception. This hands-on involvement enables studios to implement quality control measures that would be impossible in traditional models.

From Power Law to Quality Concentration

A crucial insight for institutional investors is that the venture studio model fundamentally alters the risk profile of early-stage company building by challenging one of venture capital's most deeply held assumptions.

The Strategic Divergence: Quantity vs. Quality

Traditional venture capital operates on a quantity-driven strategy designed around power law returns—where a small percentage of investments generate the majority of returns. This approach necessitates making numerous bets with the statistical expectation that most will fail but a few will succeed spectacularly enough to drive overall portfolio performance. The strategy leads to several important implications:

Portfolio construction focusing on volume (often 30+ companies per fund)

High tolerance for failed investments (typically 50-70% of the portfolio)

Minimal early-stage operational involvement to maximize deal flow coverage

A primary focus on identifying potential outliers rather than reducing failure rates

Capital allocation strategies that prioritize post-traction companies

Venture studios, by contrast, employ a fundamentally different strategic approach centered on quality concentration. Rather than accepting high failure rates as inevitable, studios invest heavily in quality systems that reshape the distribution of outcomes:

Portfolio construction focusing on fewer, higher-quality companies (typically 8-15 per fund)

Lower tolerance for failed investments, with systematic processes to terminate underperforming concepts early

Intensive operational involvement from inception through scale

Equal focus on reducing failure rates and identifying high-potential opportunities

Captures learnings to continually improve studio process and success rates

Capital allocation strategies that create value at the formation stage

This strategic divergence produces a different risk-return profile. The venture studio approach doesn't eliminate the potential for outsized returns but significantly reduces the dependency on them for overall portfolio performance. While traditional VC funds might generate returns through just 2-3 successful investments in a portfolio of 30+, studio returns typically come from a much higher percentage of their more carefully constructed portfolios.

According to Vault Fund data, the average Net IRR for venture studios with track records is 60%, compared to 33% for top quartile traditional venture capital over the same period. This performance gap isn't merely the result of a few outlier successes, but rather a systematic improvement in the quality of companies being built.

The Quality Control Framework of Venture Studios

Stage-Gate Validation Process

Unlike individual founders who often become emotionally attached to their initial concept, venture studios employ structured stage-gate processes where ideas must meet objective criteria to advance to subsequent development phases. This creates multiple quality control checkpoints:

Ideation & Initial Screening: Ideas are evaluated against market size, competitive landscape, and alignment with studio thesis

Validation: Concepts undergo rigorous market testing, customer interviews, and financial modeling

Prototype Development: Minimum viable products are built with clear performance metrics

Market Testing: Real-world deployment with defined KPIs for advancement

Scale Preparation: Operational infrastructure development and team building

Growth Execution: Systematic approach to market expansion

While specific metrics at each stage gate vary by studio, the most significant quality threshold typically occurs before full build effort commences—the point at which substantial capital is committed to the venture. At this inflection point, studios require comprehensive validation across multiple dimensions:

Market Validation: Evidence of customer interest, often quantified through specific metrics (e.g., letters of intent, pilot commitments)

Financial Validation: Projected economics that meet minimum return thresholds

Strategic Validation: Alignment with future funding and exit pathways

Team Validation: Identification of appropriate leadership with domain expertise

This structured approach stands in stark contrast to traditional founding teams, who often lack the discipline, methodology, or incentives to abandon underperforming concepts.

Venture Studios vs. Traditional VC: The Quality Control Difference

While traditional venture capital might appear to apply quality control through its staged financing approach and due diligence practices, the differences in methodology and timing are profound and consequential:

Pre-Investment vs. Post-Investment Quality Control

Traditional VC primarily applies quality filters at the investment decision stage, conducting due diligence on companies that are already formed and have made critical foundational decisions. By the time VC investment occurs, the company's DNA—including team composition, product architecture, and go-to-market strategy—is largely established. In contrast, venture studios apply quality control from the very conceptual stage, before significant resources are committed or directional decisions solidify.

Limited vs. Comprehensive Oversight

VCs typically exercise quality control through board governance, milestone-based financing, and hiring guidance—but they rarely have operational control. Studio-built companies benefit from integrated quality systems across every function from day one, including product development, technical architecture, financial operations, and talent acquisition.

Financially-Driven vs. Operationally-Driven Metrics

VC quality assessments tend to focus on financial and growth metrics that indicate progress toward the next financing round. Studios certainly track these metrics, but they also implement deeper operational quality measures—including customer discovery depth, product development velocity, technical debt metrics, and talent engagement indicators—that traditional VCs may not have visibility into or mechanisms to influence.

Single Company vs. Portfolio-Wide Learning

When VCs spot a quality issue in one portfolio company, transferring that learning to other portfolio companies is challenging due to confidentiality barriers, competitive dynamics, and limited operational involvement. Studios create systematic knowledge transfer mechanisms that ensure quality learnings from one company immediately benefit all other companies under development.

Reactive vs. Preventative Quality Controls

Traditional VC quality interventions often occur reactively—when performance indicators signal trouble. Venture studios implement preventative quality systems that avoid problems before they occur, using playbooks and standardized approaches refined across multiple company builds.

These fundamental differences in quality control approach help explain why studio-built companies demonstrate significantly higher success rates compared to VC-backed startups that emerge through traditional channels.

Examples and Case Studies

Leading venture studios have implemented distinctive quality control mechanisms that illustrate their commitment to building high-quality companies:

Alloy Innovation (formerly High Alpha Innovation) employs a clear revenue-focused validation threshold: opportunities are deemed worthy of investment only when there is line of sight to the first $100,000 in customer revenue within six months of formally starting the company. This establishes a high bar ensuring market validation is essential before capital deployment.

Pioneer Square Labs utilizes dual validation methods before company formation:

Confirming excitement and interest from follow-on capital sources

Identifying at least two potential strategic acquirers for the portfolio company

This approach ensures not only initial market validation but long-term exit potential, as having multiple potential acquirers increases the likelihood of competitive bidding and reduces the risk of failed exits due to strategic shifts at a single potential buyer.

NLC Health implements rigorous IP evaluation by gathering industry expertise on both market and technology fronts when evaluating patents to license. This dual-validation approach ensures that licensed IP is both technically sound and addresses real market opportunities—a critical quality control step for research commercialization.

OSS Ventures leverages a database of 14,000 customer discovery call transcripts to rapidly validate new concepts. This data-driven approach allows them to:

Quickly identify potential customers and appropriate buyer personas

Determine necessary interview targets and potential early customers

Assess demand size and value proposition without scheduling additional discovery calls

This systematic knowledge management approach creates a compounding quality advantage, as each new validated concept generates additional customer insights that strengthen future validation efforts.

Resource Optimization and Expertise Application

Venture studios apply shared resources across multiple company building initiatives, creating several quality advantages:

Specialized Expertise: Access to domain experts who would be prohibitively expensive for individual startups

Best Practices Implementation: Systematic application of proven methodologies

Standardized Technology Development: Leveraging common technical frameworks and infrastructure

Comparative Learning: Cross-pollination of insights from multiple simultaneous company building efforts and learnings over time

This approach is unique when compared to traditional startups, who often operate in isolation and do not receive outside expertise or best practices except through informal advisors or investor feedback. However studios invest in these capabilities because these advantages create a quality multiplier across the whole portfolio. Furthermore, by distributing specialized resources across multiple companies, studios balance the costs of these efforts with the aggregate return across a whole portfolio, not just a single startup.

For example, a venture studio focused on enterprise software might maintain a shared team of senior UX designers, security specialists, and enterprise sales strategists who work across the portfolio. This enables even early-stage ventures to benefit from top-tier expertise that would normally only be available to more mature companies.

These shared resources significantly enhance the quality of each venture through several mechanisms.

First, they provide best-in-class capabilities from day one, preventing the costly mistakes that typically occur when inexperienced founders navigate complex domains for the first time.

Second, these resources bring institutional knowledge that eliminates "reinventing the wheel" across portfolio companies, accelerating time-to-market while reducing development costs.

Third, the systematic application of proven expertise across company creation functions produces consistently higher-quality business foundations—from cleaner codebases to more robust financial systems to more effective customer acquisition strategies.

While studios incur costs to maintain these shared resources, the economic return more than justifies the investment. This efficiency stems from faster time-to-market (reducing burn rates), lower failure rates (preserving capital), and higher-quality products at launch (accelerating revenue generation). When measured on an IRR basis, the specialized resources actually increase returns by enabling more successful outcomes per dollar invested despite the additional overhead—a counterintuitive finding that challenges the conventional wisdom about "lean" startup approaches.

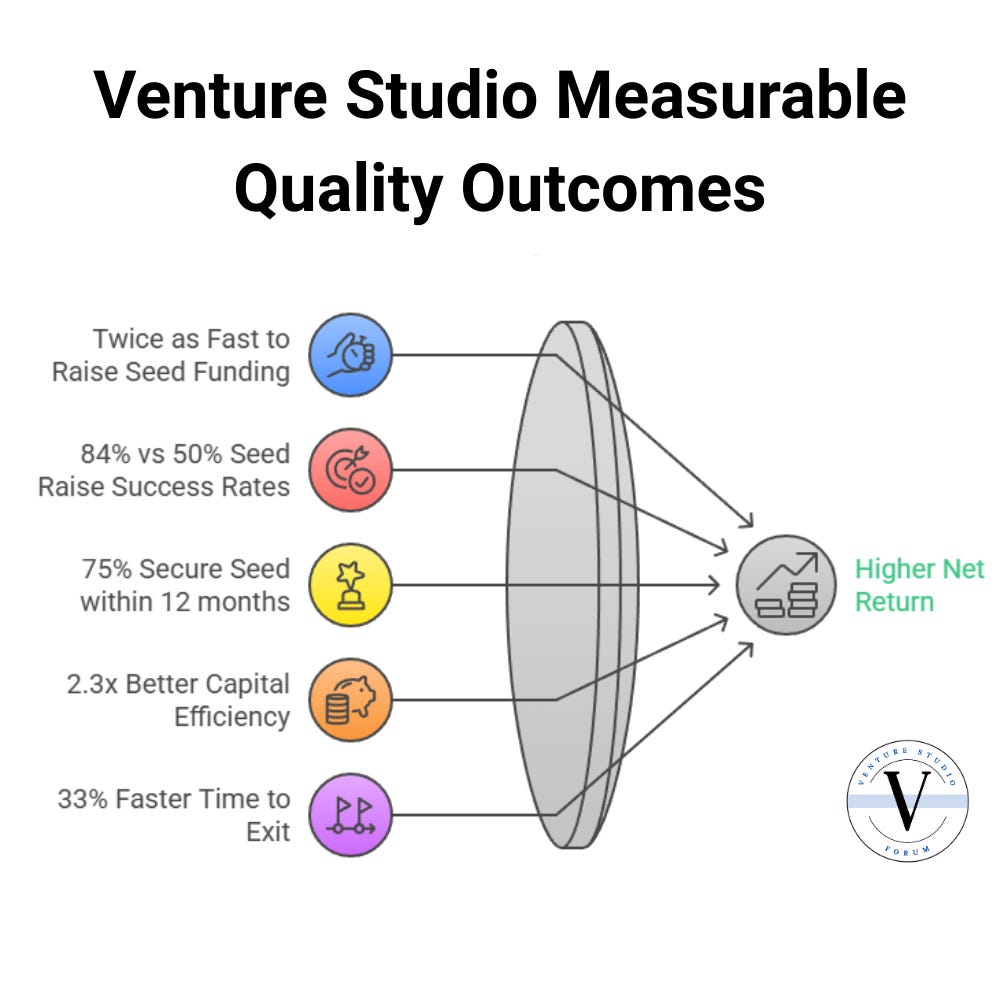

Measurable Quality Outcomes

Why does studios even both to invest in capabilities and processes to fine tune the company-creation process? To a lay investor, these efforts may look like needles expense, wasting precious dollars which could be deployed into more companies. But that that is not what the data shows.

The quality-focused approach of venture studios yields measurable performance improvements compared to traditional startup models:

Time to Market: Studio-built companies reach seed funding twice as fast as conventional startups (GSSN, 2022)

Success Rates: 84% of venture studio startups secure seed funding, compared to industry averages below 50%

Milestone Achievement: Studio companies demonstrate 75% success in reaching follow-on funding within 12 months

Capital Efficiency: Average of 2.3x capital efficiency compared to traditional startups

Time to Exit: 33% faster time to acquisition (5 years vs. 7.5 years for traditional startups)

These metrics reflect the fundamental quality differences in venture studio-built companies compared to conventional startups. By implementing systematic quality control throughout the company building process, studios eliminate many of the preventable failure modes that plague traditional startups—effectively derisking venture creation at each stage of development. By doing so, they create a higher net return for the portfolio.

The Quality Imperative

The venture studio model represents a fundamental rethinking of company creation, one that prioritizes integrated ideation, execution, and investment with a focus on quality control and efficiency. By implementing rigorous processes, leveraging specialized expertise, and applying systematic validation methodologies, venture studios dramatically derisk the entrepreneurial process and deliver measurably superior outcomes compared to traditional startup formation approaches.

For institutional investors, this quality-first framework offers a compelling alternative to conventional venture capital allocation strategies. Rather than depending on power law returns from a small percentage of investments, venture studios provide a model that enhances baseline quality across the portfolio, potentially delivering more consistent returns with reduced risk.

As the model continues to mature and demonstrate its effectiveness, venture studios are poised to become an increasingly important component of institutional portfolios, particularly for investors who value quality company building over high-volume investment strategies.

References

Anderson, Sarah. “What Is a Venture Studio? - Vault Fund.” Vault Fund, 27 Aug. 2021, vaultfund.com/what-is-a-venture-studio/.

Dario, Nelson, and Muñoz Abreu. VENTURE STUDIOS: ANALYZING a NEW ASSET in the VENTURE ECOSYSTEM. 2021.

Doyle, Megan. “The Venture Studio Business Model Explained.” Nextbigthing.ag, 2021,

nextbigthing.ag/blog/venture-studio-business-model-explained/.

Kennedy, Scott. “Venture Studios: The New Way to Build a Tech Startup.” Edition, 19 Mar. 2025, www.editiongroup.com/us/insights/what-is-a-venture-studio.

Nows, David and Trautman, Lawrence J., The Growing Role of Venture Studios in Startup Finance (February 04, 2025). 76 Case Western Reserve Law Review (Forthcoming) (2026), Available at SSRN: https://ssrn.com/abstract=

Pog, Max. “Big Startup Studios Research 2023.” Inniches.com, 4 Sept. 2023, inniches.com/startup-studios-research.

Yoskovitz, Ben. “5 + 1 Predictions for Venture Studios in 2025.” Focusedchaos.co, Focused Chaos, 10 Dec. 2024, www.focusedchaos.co/p/predictions-for-venture-studios-2025.

---. “How to Build a Venture Studio: The Checklist.” Focusedchaos.co, Focused Chaos, 5 Dec. 2023, www.focusedchaos.co/p/how-to-build-a-venture-studio. Accessed 31 Mar. 2025.

About the Author

Matthew Burris serves as the Senior Director of Research at the Venture Studio Forum, where his mission is to transition venture studios from an emerging asset class to an established asset class. In this role, he leads the creation of the rigorous data frameworks and due diligence standards required for institutional adoption.

This research is built upon the proprietary insights Matthew developed as Partner & Head of Insights at the 9Point8 Collective. By codifying the methodologies from his advisory work with corporate, university, economic development, and private studios, he provides the Forum with the foundational architecture needed to define the industry.

Connect with Matthew on LinkedIn.