The Three-Role Framework of Venture Studios

A Definitive Classification of Venture Studios

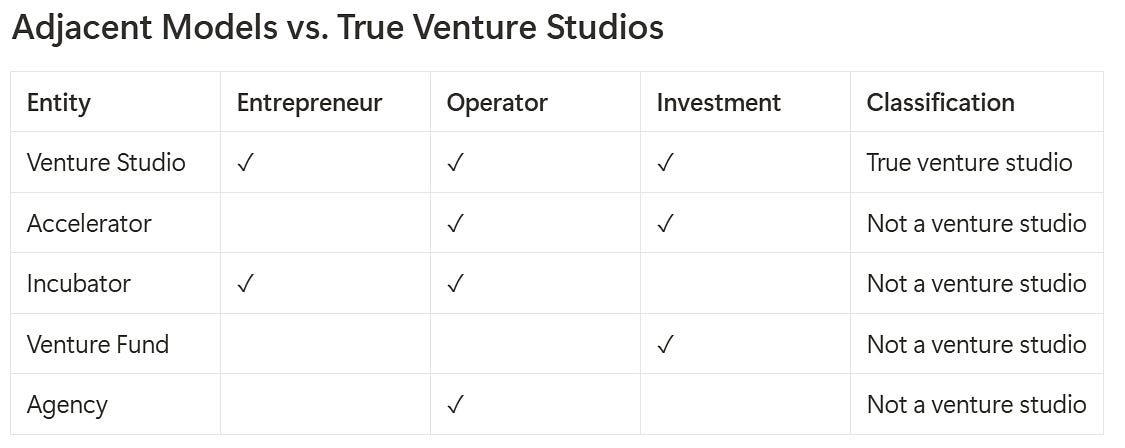

A venture studio is a company that systematically creates other companies by exercising meaningful control across three core roles: entrepreneur, operator, and investor. This formal definition provides a clear classification framework that distinguishes true venture studios from adjacent models, creating accountability, fostering transparency, and enabling the establishment of venture studios as a legitimate institutional asset class.

Introduction: Why Definition Matters

In 2023, more than 800 organizations worldwide identified themselves as "venture studios," yet many lacked the essential characteristics that define the model. This definitional ambiguity creates significant challenges throughout the ecosystem:

For investors, the absence of clear standards makes it difficult to evaluate opportunities, compare performance, and allocate capital efficiently. Without precise classification, investors cannot distinguish between true venture studios and organizations that may adopt the label while providing lower value.

For founders, partnering with a misclassified studio can lead to inadequate support, unrealistic equity demands, and failed ventures. When a service provider or advisor positions itself as a venture studio but lacks the core capabilities, founders receive less value while giving up significantly more equity than they should.

For the broader market, this confusion inhibits the recognition of venture studios as a distinct asset class, limiting institutional capital flow, standardization of practices, and ultimately hindering innovation.

The stakes are substantial. Venture studios represent a powerful innovation model that has experienced explosive growth— the total number of Venture studios doubled from 2018 to 2023, a 7 year period, to 877 globally. As venture funding becomes increasingly competitive, the venture studio model offers a differentiated approach to company creation with compelling performance metrics:

Studio-backed startups reach Series A at a ~72% rate versus ~42% for traditional startups

Average IRRs for venture studios are approximately 53% compared to 21% for traditional venture capital

Studio portfolios achieve average TVPI (Total Value to Paid-In) multiples of 5.8x

Studios reduce time from zero to Series A by more than half (25 months vs. 56 months for traditional startups)

Moreover, studio-founded companies have attracted over $70 billion in follow-on capital, demonstrating their increasing legitimacy in the marketplace. However, these advantages can only be fully realized if the market can clearly distinguish genuine venture studios from adjacent models.

This article introduces a formal three-role framework that defines the essential characteristics of venture studios. This framework provides a testable standard against which any organization claiming to be a venture studio can be evaluated, bringing necessary clarity to this rapidly evolving segment of the venture landscape.

Current Landscape: Confusion in Classification

Today's venture ecosystem features numerous players that support early-stage companies, including:

Venture capital firms: Provide capital and strategic guidance to existing startups

Accelerators: Offer cohort-based, time-bound programs to help startups accelerate growth

Incubators: Provide shared resources and support for nascent startups

Agencies/consultancies: Build products or provide services for hire

Talent investors: Identify promising individuals and help them launch companies

The boundaries between these models have increasingly blurred, with many organizations adopting the "venture studio" label regardless of their actual capabilities or engagement model. This creates a market filled with misinformation and false equivalencies.

The confusion is understandable—venture studios share some characteristics with these adjacent models. Like accelerators, they provide operational support. Like VCs, they invest capital. Like agencies, they may employ teams that build products. Yet a true venture studio integrates these functions into a cohesive system that is fundamentally different from any of these models individually.

The Three-Role Framework: A Formal Definition

Definition:

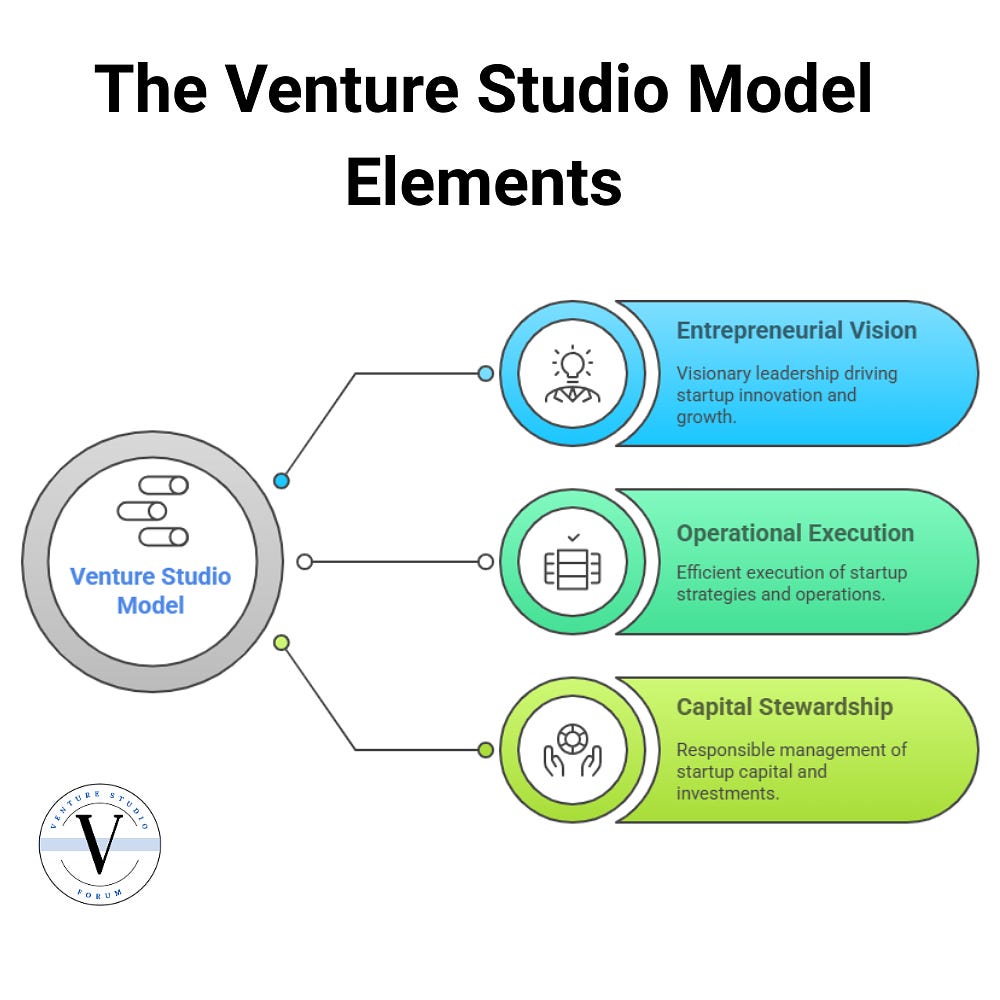

A venture studio is a company that systematically creates other companies by exercising meaningful control across three core roles: entrepreneur, operator, and investor. What distinguishes true venture studios is not merely involvement in these functions, but their active direction and orchestration across all three domains.

Let us examine each role in detail:

Role 1: The Entrepreneur — Chief Architect of Innovation

As entrepreneurs, venture studios function as systematic ideation engines, maintaining strategic control over the zero-to-one phase of company creation. This role encompasses:

Idea generation and validation: Systematically sourcing, vetting, and refining business concepts before committing resources

Vision crafting: Developing compelling market narratives and strategic positioning for new ventures

Strategic direction-setting: Making foundational decisions about market entry, target customers, and business model

Unlike venture capital firms that evaluate external opportunities, venture studios decide internally what companies to create, gather necessary technologies, establish the legal entities, and maintain significant foundational ownership. In a sense, they're closer to masterful chess players who strategically position pieces across the board rather than poker players who must play the hand they're dealt.

Role 2: The Operator — Master Builder of Companies

In the operator role, venture studios actively construct the operational foundation of their portfolio companies. Rather than simply providing advice and introductions (as accelerators typically do), studios roll up their sleeves and execute.

Key operator functions include:

Product development: Managing the creation process from concept to market-ready product

Technical resource allocation: Deploying engineering and design talent efficiently across portfolio companies

Go-to-market execution: Implementing sales, marketing, and business development strategies

Operational systems development: Building scalable processes and infrastructure

Data supports the effectiveness of this hands-on approach: venture studios reduce the time from concept to Series A by more than 50% compared to traditional startups, with portfolio companies achieving Series A success rates of approximately 60% versus the industry average of around 25% and even beating YCombinator’s impressive 45% success rate.

Role 3: The Investor — Strategic Capital Steward

As investors, venture studios exercise careful stewardship over capital deployment, conducting rigorous due diligence and protecting invested capital through active portfolio management.

The investor role includes:

Capital allocation: Determining which opportunities receive funding and in what amounts

Portfolio construction: Building a balanced set of companies that reflect the studio's thesis

Financial structuring: Designing equity arrangements and investment terms

Risk management: Monitoring portfolio performance and making follow-on investment decisions

Crucially, a venture studio is fundamentally an equity-driven business model, not a cash flow or services business. The primary returns come from equity ownership in portfolio companies, whether through exits, licensing revenue, or profit distributions. While studios may charge nominal fees to portfolio companies for certain services, this should never be a significant revenue stream. Studios that depend on service revenue compromise their core mission of company building and their fiduciary duty to investors.

Variations Within the Model

While the three-role framework establishes the fundamental definition of a venture studio, significant variation exists within this classification. Studios can differ in their investment focus and operational approach while still meeting the core definition. These variations include:

Investment/Return Profile:

Deeptech studios focus on frontier technologies with significant upside potential

Venture-return studios target high-growth scalable businesses in established categories

Growth-focused studios emphasize proven business models with execution advantages

Income-focused studios build sustainable, cash-flowing businesses

Engagement Approach:

Founder-model studios generate ideas and execute internally before bringing in management

Cofounder studios partner with entrepreneurs from the earliest stages

Late Cofounder studios can partner with an existing company and team as a cofounder and build the company together

Refounder studios revitalize existing assets or IP with new teams and strategies

These variations highlight the rich diversity within the venture studio landscape while maintaining adherence to the core three-role definition. Future classifications will explore these dimensions more thoroughly, but our focus here is establishing the foundational definition that qualifies an organization as a venture studio.

The Venture Studio Identity Test: Applying the Framework

The three-role framework provides a clear, testable standard against which any organization claiming to be a venture studio can be evaluated. This "Venture Studio Identity Test" examines how an organization functions across the entrepreneurial, operational, and investment dimensions.

Case Studies: The Framework in Action

To illustrate how the three-role framework applies in practice, let's examine several leading venture studios and how they fulfill these roles:

Rocket Internet: The Operational Scaling Pioneer

Rocket Internet exemplifies the three-role framework with particular emphasis on operational execution:

Entrepreneur role: Rocket systematically identifies successful business models (primarily from the U.S.) and adapts them for emerging markets, making strategic decisions about geography, business model, and market entry.

Operator role: Their execution prowess is legendary—deploying hundreds of staff across engineering, marketing, and operations to rapidly scale replicated models like Zalando (fashion retail), Jumia (the "African Amazon"), and Lazada (Southeast Asian e-commerce).

Investor role: Rocket deployed significant capital, often maintaining majority ownership early on, and was disciplined about capital allocation across its portfolio of 100+ companies in 50+ countries.

By 2013, Rocket had built a portfolio valued at billions, with several companies reaching unicorn status. Their approach to the three roles delivered remarkable efficiency—by focusing on proven business models, they reportedly improved startup success rates to "5 in 10" versus the typical "1 in 10" for traditional venture.

High Alpha: The Enterprise SaaS Studio

High Alpha demonstrates the three-role framework with a sector-specific focus on B2B SaaS:

Entrepreneur role: Founded by the former ExactTarget CEO, High Alpha systematically generates ideas around enterprise software opportunities, validating concepts before company formation.

Operator role: Their team provides specialized product development, go-to-market support, and recruiting for portfolio companies, with dedicated staff across design, engineering, and marketing.

Investor role: High Alpha not only provides initial capital but has raised multiple funds (~$260M total) to support their companies through later stages, structuring deals to maintain significant ownership.

High Alpha has launched over 30 startups, with multiple successful exits including Lessonly (acquired by Seismic) and several others that have raised significant follow-on funding. Their disciplined execution of all three roles is reflected in their performance metrics.

eFounders/Hexa: The European SaaS Factory

eFounders (now Hexa) exemplifies the three-role framework with a focus on "future of work" SaaS companies:

Entrepreneur role: eFounders develops concepts internally, validates them with potential customers, and makes key strategic decisions before bringing in external co-founders.

Operator role: Their dedicated team works hands-on with portfolio companies for 12-18 months, handling product development, branding, and initial go-to-market before "graduation."

Investor role: While initially self-funded, eFounders deploys capital into each venture and structures equity to maintain significant ownership (~30% post-seed), with disciplined portfolio management.

Over a decade, eFounders built a portfolio of 30+ companies valued at over $5 billion, including notable successes like Front (valued ~$1.7B), Aircall (valued $1B+), and Spendesk. Their rigorous execution of all three roles has established them as one of Europe's premier venture studios.

Addressing Skepticism: Why Definition Matters

A common critique of the venture studio model is that the category is too heterogeneous to classify—that studios are too diverse in their approaches, structures, and focuses to be treated as a unified asset class. This concern is valid but addressable.

The beauty of the three-role framework is that it establishes a foundational classification that accommodates this diversity while providing a clear boundary. Just as both growth and value investors fall under the umbrella of "equity managers" despite their different approaches, venture studios can vary in their strategies while sharing essential characteristics.

The three-role definition serves as the first level of classification—is this a venture studio or not?—which then enables further categorization and analysis. Without this fundamental definition, the market remains confused, with organizations adopting the "venture studio" label opportunistically regardless of their actual capabilities.

As the industry matures, studios themselves have recognized this challenge. At the Venture Studio Forum, a global trade association for the venture studio ecosystem, we explicitly focus on "defining venture studios as an asset class" and creating "industry-accepted standards and benchmarks." This framework is part of a series of foundational frameworks that establish formal definitions and assessment frameworks for the venture studio asset class.

The Path to Institutional Asset Class Status

The three-role framework represents a critical step toward establishing venture studios as a legitimate institutional asset class. As with the evolution of other alternative asset classes like venture capital, private equity, and REITs, classification clarity is essential for institutional adoption.

The history of these asset classes is instructive. Venture capital was once a niche, poorly understood investment approach. The clarification of the Limited Partner/General Partner model, standardization of fund structures, and development of clear performance metrics helped transform VC from a cottage industry into a recognized asset class that now attracts hundreds of billions in institutional capital annually.

REITs followed a similar path—beginning as an investment structure created by legislation in 1960, they gradually developed standard classifications (equity, mortgage, hybrid) and performance benchmarks that enabled institutional investors to incorporate them into allocation strategies.

Hedge funds likewise evolved from loosely defined investment partnerships into a sophisticated asset class with established strategies (long/short, market neutral, global macro) and performance categories.

Venture studios are following this trajectory. By establishing clear definitional boundaries through the three-role framework, we create the foundation for:

Standardized Evaluation: Enabling comparative analysis across studios

Performance Benchmarking: Developing appropriate metrics for the asset class

Regulatory Clarity: Defining how venture studios should be treated under investment regulations

Allocation Categories: Helping institutional investors create appropriate allocation buckets

Early data suggests that this emerging asset class merits institutional attention. Studies indicate that venture studios achieve exit rates of ~34% compared to ~21% for accelerator-born companies, while maintaining larger equity positions (30-50% vs. 6-8% for accelerators). The combination of higher success rates and larger ownership positions potentially addresses key limitations of traditional venture investing.

Conclusion: Definitional Clarity as a Catalyst for Growth

The venture studio model represents a significant innovation in company creation—one that could potentially reshape how startups are built and funded. However, its continued evolution and eventual institutional acceptance depend on clear classification standards that distinguish true venture studios from adjacent models.

The three-role framework provides this essential clarity. By defining venture studios through their integrated entrepreneur-operator-investor functions, we establish a testable standard that brings accountability to the market and helps all stakeholders make more informed decisions.

For venture studios to realize their potential as the next significant asset class in the alternative investment landscape, this definitional clarity is not merely academic—it's foundational. Just as standardized structures and definitions helped venture capital evolve from a cottage industry into a cornerstone of innovation finance, the three-role framework can help venture studios develop from an experimental model into a recognized, institutionalized approach to company creation.

Organizations that truly embody all three roles—entrepreneurial vision, operational execution, and capital stewardship—deserve recognition as venture studios. Those that do not should be classified according to their actual capabilities, whether as operationally-involved VCs, equity-compensated agencies, or another model entirely. This clarity benefits everyone in the ecosystem and unleashes the full potential of the venture studio approach.

References

Blank, S. (2022). "Entrepreneurs, Is a Venture Studio Right for You?" Harvard Business Review.

Chambless, S., & Sagot, J. (2023). "Venture Studios – Startup Formation and Initial Capitalization Considerations." Fenwick & West LLP.

Global Startup Studio Network (2020). "Disrupting the Venture Landscape." GSSN Whitepaper.

Kovalevich, D. (2021). "The Roast of the Startup Studio Model." Medium.

Lesage, D. (2023). "The 2023 Venture Studio Market Map." Medium.

Muñoz, N. (2021). "Analyzing a New Asset in the Venture Ecosystem." MIT Thesis.

Rock, A. (1987). "Strategy vs. Tactics from a Venture Capitalist." Harvard Business Review.

Vault Fund (2023). "Company Creator Insights." Vault Fund Industry Report.

Vault Fund (2023). "Understanding the Impact of Company Creation Fund Structures." Vault Fund White Paper.

Vault Fund (2022). "Venture Studio Primer." Vault Fund White Paper.

Venture Studio Forum (2024). "Defining Venture Studios as an Asset Class." VentureStudioForum.org.

About the Author

Matthew Burris serves as the Senior Director of Research at the Venture Studio Forum, where his mission is to transition venture studios from an emerging asset class to an established asset class. In this role, he leads the creation of the rigorous data frameworks and due diligence standards required for institutional adoption.

This research is built upon the proprietary insights Matthew developed as Partner & Head of Insights at the 9Point8 Collective. By codifying the methodologies from his advisory work with corporate, university, economic development, and private studios, he provides the Forum with the foundational architecture needed to define the industry.

Connect with Matthew on LinkedIn.