The Venture Studio Index:

A Due Diligence Framework for evaluating Venture Studios

The emergence of venture studios represents one of the most significant structural innovations in early-stage company creation since the rise of accelerators a decade ago. With data indicating average net IRRs of 60% compared to 33% for top-quartile traditional venture capital, these systematic company creators are drawing increased attention from institutional investors, family offices, and high-net-worth individuals. Yet despite this outperformance, investors face significant complexity when evaluating these hybrid entities that combine entrepreneurial, operational, and investment functions traditionally separated in the startup ecosystem.

This article introduces the Venture Studio Index (VSI), a comprehensive due diligence framework designed to bring Morningstar-like standardization to venture studio evaluation. By adapting established investment assessment methodologies to this emerging asset class, the VSI enables investors to evaluate studios across five critical dimensions, benchmark performance against appropriate peer groups, and make informed allocation decisions aligned with their portfolio objectives.

A one page VSI report on ‘Innovate Horizons’ a fictional studio based on a public composite of three deeptech venture studios. Pre-release Version

The Venture Studio Evaluation Challenge

For institutional investors, venture studios represent a fundamentally different model than traditional venture capital firms. While most VC firms primarily function as capital allocators to founder-led startups, venture studios actively create, build, and scale companies using systematic processes and shared resources. This multidimensional role—spanning idea generation, company formation, operational support, and investment—requires a more nuanced evaluation framework than conventional venture due diligence approaches.

The challenge for investors is further complicated by significant variation within the studio landscape itself. As the Vault Fund, notes in their 2023 Company Creator Insights Report, "Many different structures can provide strong performance, and while most investors are not comfortable with holding companies, they can be lucrative for limited partners and should be considered a viable, institutional-level investment."

This variation creates several challenges for allocators:

Structural complexity: Studios employ diverse legal and economic structures, from traditional fund vehicles to holding companies and hybrid models.

Economic opacity: The true costs and value creation mechanisms are often obscured by complex fee structures and service arrangements.

Performance attribution: It's difficult to determine which aspects of a studio's approach drive outperformance.

Benchmarking obstacles: Without standardized categories, investors struggle to make meaningful comparisons between studios.

Strategy alignment: Different studio models align with different portfolio objectives, requiring careful matching.

The Venture Studio Index: A Standardized Framework

The VSI addresses these challenges by providing investors with a systematic approach to evaluate venture studios across five essential dimensions, each containing specific metrics and evaluation criteria that directly impact performance outcomes.

Dimension 1: Value Creation Approach

The VSI first categorizes studios by their fundamental approach to value creation and risk profile. This dimension identifies how a studio generates returns, which directly impacts portfolio construction decisions and appropriate benchmarking.

Studios typically fall into one of four categories:

Deep Tech Focus: Studios concentrating on frontier technologies with significant technical risk but extraordinary potential upside. These studios typically:

Develop proprietary technologies with significant barriers to entry

Target breakthrough innovations in fields like biotech, quantum computing, or advanced materials

Accept longer timelines to exit (often 8-12+ years)

Venture-Return Focus: Studios building companies using established technologies to address large market opportunities with business model innovations. These studios typically:

Target high-growth sectors with established technology stacks

Focus on business model innovation and market timing

Operate on typical venture timeframes (5-8 years to exit)

PE-Focused Approach: Studios building companies for strategic acquisition rather than public market exits, targeting established markets with predictable acquisition paths. These studios typically:

Identify gaps in established industry verticals

Build companies designed as acquisition targets for specific strategic buyers

Focus on rapid value creation with shorter paths to exit (3-5 years)

Cashflow Focus: Studios building companies designed for sustainable profitability and regular distributions rather than terminal exits. These studios typically:

Target established markets with proven business models

Focus on execution excellence rather than innovation

Often operate in service businesses or digital commerce

Dimension 2: Formation Model

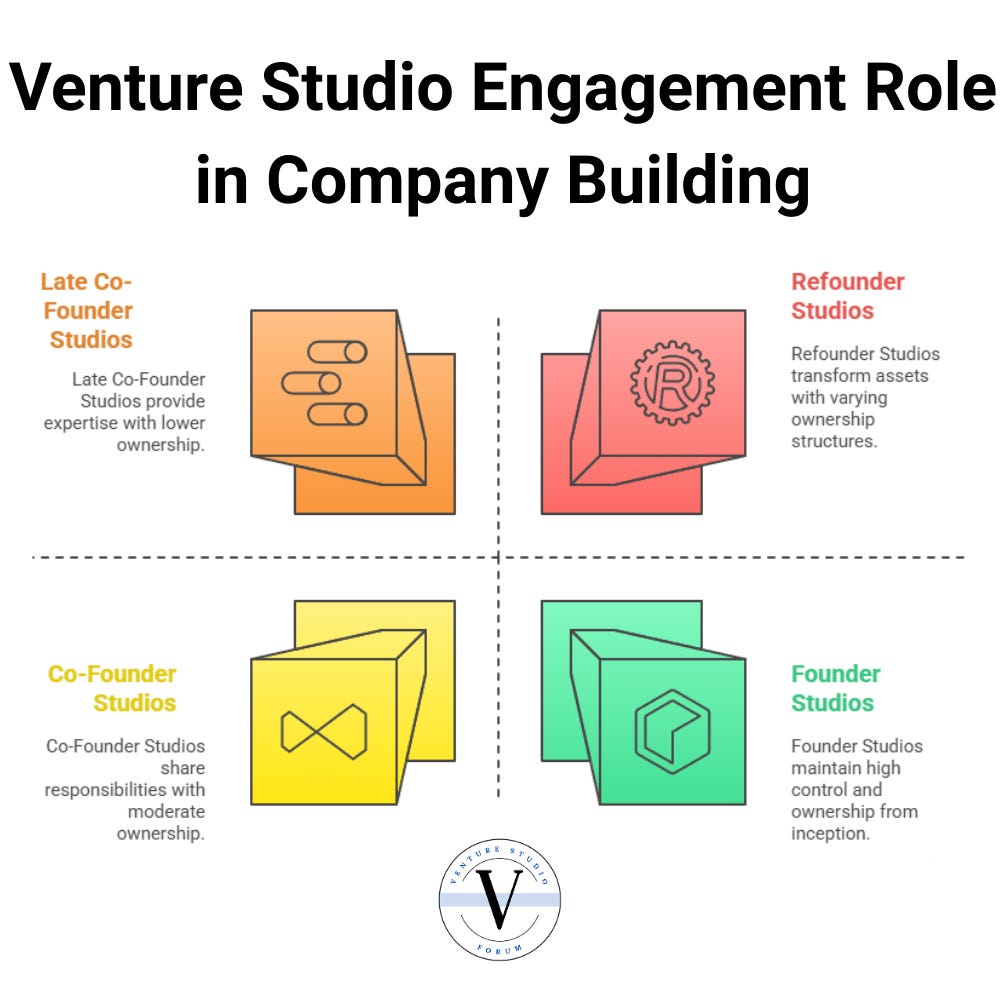

The second dimension evaluates how studios engage in the company building process—a critical factor in assessing their capabilities and value-add potential.

Founder Studios: Generate ideas internally, validate them, and then recruit CEOs or external co-founders to lead the companies. These studios:

Maintain complete control over the ideation and validation process

Act as the true creator of the business concept

Are involved from the earliest conceptual stage

Co-Founder Studios: Partner with entrepreneurs from inception, collaborating on ideation and validation from the earliest stages. These studios:

Work side-by-side with external entrepreneurs

Share founder responsibilities more equally

Provide hands-on operational support throughout company building

Late Co-Founder Studios: Join existing early-stage ventures that have already validated an idea or built early product versions. These studios:

Provide specialized expertise and resources to accelerate growth

Focus on operational scaling rather than ideation

Address specific company-building challenges

Refounder Studios: Acquire or license existing assets, technologies, or underperforming companies and reinvent them with new teams and strategies. These studios:

Transform existing assets rather than creating new ones

Focus on repositioning and revitalization

Often leverage undervalued IP or customer bases

Dimension 3: Operational Role Assessment

The third dimension evaluates a studio's capabilities across three core roles that impact company success rates, value creation potential, and economic returns:

Entrepreneur Role: Assesses the studio's ability to generate, validate, and develop viable business concepts. Key performance indicators include:

Idea conversion rate: Percentage of concepts that advance to funded companies

Time to market: Average months from concept to commercial product

Time to revenue: Average months from concept to meaningful customer revenue

Founding team quality: Experience and success rates of recruited entrepreneurs

Operator Role: Measures the studio's ability to provide operational support and acceleration to portfolio companies. Key performance indicators include:

Resource efficiency: Cost per company launched

Team load ratio: Number of active companies per operational staff member

Time to scale: Average months from launch to institutional funding

Specialized expertise: Depth of domain-specific knowledge and capabilities

Investor Role: Evaluates the studio's capital deployment strategy and investment performance. Key performance indicators include:

Capital efficiency: Equity value created per dollar invested

Follow-on success: Percentage of companies securing institutional funding

Time to next round: Average months between funding stages

Exit value: Distribution of exit multiples across the portfolio

According to the Vault Fund, “Unlike traditional VC firms that primarily deploy capital, venture studios actively build and scale companies from inception.” Investors are very used to paying a 2% management fee for ten years for a fund to play the investor role, but venture studios play two additional roles: the entrepreneur role and the operator role. Those additional roles do not come free and as the Vault Fund emphasizes, “This operational intensity requires different evaluation criteria.”

Dimension 4: Cost Structure and Capital Efficiency

The VSI examines how studios deploy capital across five distinct categories, providing investors with clear visibility into the economics of company creation:

Studio SG&A: Operating expenses required to maintain the studio entity itself, independent of specific portfolio company creation activities.

Cost of Builds: Direct operational expenses incurred during ideation, validation, and early development phases before company spinout.

Initial Company Capitalization: Minimal capital deployed into newly formed portfolio companies to legally establish the entity and secure common equity.

Primary Investment Capital: Structured investment capital typically securing preferred equity, deployed as an internal investment round.

Follow-On Investment Allocation: Capital designated for participation in subsequent financing rounds of portfolio companies.

This transparency allows investors to calculate critical efficiency metrics such as:

Total studio cost per company created

Cost per equity point secured

Ratio of operational expenses to investment capital

Equity composition (common vs. preferred)

As noted in the Fenwick white paper on venture studio capitalization strategies, "If the venture studio's aggregate equity stake is too big, then there may not be enough equity available to entice individual co-founders, early executives, and other potential studio startup team members to join the studio startup—or to provide adequate incentives to those individuals and other future service providers over the long term—all of which may create challenges in future financings."

Dimension 5: Portfolio Construction and Return Profile

The final dimension examines how the studio's overall portfolio is structured and the resulting expected return profile:

Portfolio Concentration: The number and diversity of companies built, reflecting the studio's risk management approach.

Company Development Timeline: The average time from concept to exit or significant follow-on funding, which directly impacts capital efficiency and IRR.

Ownership Strategy: The studio's approach to securing and maintaining ownership through follow-on rounds, including pro-rata participation policies.

Return Distribution: Historical or projected distribution of returns across the portfolio, which should align with the value creation approach identified in Dimension 1.

This dimension helps investors understand whether a studio's portfolio construction approach aligns with their own investment objectives and return expectations. As Arthur Rock noted in his seminal HBR article, "Strategy is easy, but tactics—the day-to-day and month-to-month decisions required to manage a business—are hard." The portfolio construction dimension evaluates precisely these tactical decisions that ultimately drive returns.

Implementing the VSI in Investor Due Diligence

The Venture Studio Index not only provides investors with a structured evaluation framework but also guides the due diligence process itself. Here's how different investor types can implement the VSI in their allocation decisions:

For Institutional Investors

Institutional investors should focus their due diligence on systematically evaluating a studio across all five VSI dimensions, with particular emphasis on:

Structural Alignment: Does the studio's legal and economic structure align with the institution's investment parameters? For example, do pension funds requiring regular distributions match better with cashflow-focused studios?

Risk-Return Calibration: Does the studio's value creation approach and formation model align with the institution's risk appetite and return expectations?

Operational Scalability: Can the studio's quality control systems and processes effectively scale to deploy the institution's capital allocation efficiently?

Governance and Reporting: Does the studio provide sufficient transparency and governance controls to meet institutional requirements?

Performance Benchmarking: How does the studio's historical performance compare to appropriate benchmarks within its VSI classification?

For Family Offices and HNWI

Family offices and high-net-worth individuals often have more flexibility in their investment approach and may emphasize different elements of the VSI:

Strategic Alignment: Does the studio's sector focus and expertise align with the family's strategic interests or existing business operations?

Value-Add Beyond Returns: What additional benefits beyond financial returns (access to innovation, business development opportunities, etc.) does the studio relationship provide?

Direct Involvement Opportunities: Does the studio offer appropriate mechanisms for more active involvement if desired?

Liquidity Profiles: Does the studio's approach to creating interim liquidity events match the family office's cash flow needs?

Long-term Relationship Potential: Does the studio offer opportunities for multi-fund relationships or strategic partnerships?

VSI in Action: A Structured Due Diligence Process

When implementing the VSI as a due diligence framework, investors should follow a structured approach:

Phase 1: Initial Classification

Determine the studio's position in the Value Creation Approach dimension

Identify the studio's Formation Model

Establish appropriate peer comparisons based on these classifications

Phase 2: Role Analysis

Assess the studio's capabilities across the three core roles (Entrepreneur, Operator, Investor)

Evaluate the alignment between capabilities and stated strategy

Benchmark role performance against appropriate peer groups

Phase 3: Structural and Economic Analysis

Analyze the studio's cost structure using the five-category framework

Calculate key efficiency metrics (cost per company, cost per equity point)

Evaluate the alignment between economic structure and stated strategy

Phase 4: Portfolio and Return Analysis

Analyze historical or projected portfolio construction

Evaluate ownership strategies and their effectiveness

Assess the alignment between stated strategy and actual return patterns

Phase 5: Decision Framework

Determine strategic fit with portfolio objectives

Assess relative value compared to alternative investment opportunities

Structure investment terms to align incentives and manage risks

Case Study: Applying the VSI to Venture Studio Evaluation

To illustrate the practical application of the VSI framework, consider the following simplified case study of two venture studios with different approaches:

Studio Alpha is classified as a Venture-Return focused Founder Studio. Its role assessment reveals strong entrepreneurial capabilities (4.5/5) with systematic idea generation and validation, good operational capabilities (4/5) with dedicated functional experts, and moderate investment capabilities (3.5/5) with some limitations in follow-on strategy. The cost structure analysis shows efficient company creation ($600K per company) with 70% of capital allocated to direct company building. Portfolio construction reveals a balanced approach with 15 companies built over 5 years, initial ownership averaging 35%, and a follow-on strategy that maintains ownership in top performers.

Studio Beta is classified as a PE-Focused Late Co-Founder Studio. Its role assessment shows moderate entrepreneurial capabilities (3/5) focused more on company transformation than original ideation, strong operational capabilities (4.5/5) with industry-specific expertise, and strong investment capabilities (4.5/5) with sophisticated capital strategies. The cost structure analysis reveals higher per-company costs ($900K) but with 80% of capital deployed as structured investments. Portfolio construction shows a concentrated approach with 8 companies built over 5 years, initial ownership averaging 25%, and a disciplined path to strategic exits.

Through the VSI framework, an institutional investor can determine that Studio Alpha represents a higher-risk, higher-potential-return opportunity more suitable for their venture allocation, while Studio Beta offers a more predictable return profile aligned with their private equity portfolio objectives. This clarity enables more precise allocation decisions and appropriate performance expectations.

The Future of Venture Studio Due Diligence

The Venture Studio Index represents a significant step toward establishing venture studios as a defined institutional asset class with clear evaluation frameworks. By standardizing how we analyze these entities across multiple dimensions, we enable more informed capital allocation decisions, better alignment between investors and studios, and ultimately, a more efficient ecosystem for company creation.

As the category continues to mature, we expect the VSI to evolve with increasingly granular metrics and benchmarks. According to data from Vault Fund, the venture studio model demonstrates average net IRRs of 60% compared to 33% for top-quartile traditional venture capital. This performance differential suggests that systematic company creation, when properly executed, can drive superior risk-adjusted returns compared to traditional venture models.

Sophisticated investors who adopt this framework early will gain a significant advantage in identifying the highest-performing studios and constructing optimized allocations to this emerging asset class. By bringing the analytical rigor of established investment frameworks to the venture studio landscape, the VSI helps bridge the gap between traditional investment approaches and this innovative model of company creation.

The Venture Studio Index is a core effort of the Venture Studio Forum to establish standards for the asset class. To learn more, support the VSI, or get access to the VSI, join the Venture Studio Forum or reach out to Matt Burris or Neal Ghosh.

This article is part of a series of articles formalizing and defining venture studios as an asset class. Together this articles form the foundational definitions of the venture studio model and provide a framework for comprehensive evaluation. Matthew Burris and Neal Ghosh are the primary authors of the Venture Studio Index, Venture Studio Cost Structure Model, and the core frameworks within the Venture Studio Index. These frameworks are based on their work designing, building, and operating venture studios and Matt’s review of over 500 venture studios globally.

About the Authors

Matthew Burris serves as the Senior Director of Research at the Venture Studio Forum, where his mission is to transition venture studios from an emerging asset class to an established asset class. In this role, he leads the creation of the rigorous data frameworks and due diligence standards required for institutional adoption.

This research is built upon the proprietary insights Matthew developed as Partner & Head of Insights at the 9Point8 Collective and study of over 500 venture studios globally. By codifying the methodologies from his advisory work with corporate, university, economic development, and private studios, he provides the Forum with the foundational architecture needed to define the industry.

Connect with Matthew on LinkedIn.

Neal Ghosh serves as President of the Venture Studio Forum, the global community dedicated to advancing data standards, research infrastructure, and professional practices for the venture studio asset class. In this role, he guides the Forum’s long-term strategy—shaping industry benchmarks, commissioning cross-institutional research, and developing programs that support practitioners across the full spectrum of studio models.

Neal Ghosh is also Co-Founder and Managing Partner of the 9Point8 Collective, where he leads strategy and portfolio management across a multi-studio ecosystem spanning universities, corporations, economic development groups, and private venture builders. His work focuses on designing the operating systems, governance structures, and commercialization pathways that enable venture studios to function as scalable, institutional-grade company-creation platforms rather than one-off innovation experiments.

His perspective is grounded in more than a decade of experience building and operating innovation portfolios, including prior work at Cogo Labs, where he led research and strategy for a data-driven model for venture creation, and at Amazon.com, where he co-founded a deep tech innovation lab. Neal holds a PhD in economics from the University of Texas at Austin, a foundation that informs his focus on capital efficiency, portfolio design, and the economics that underpin durable venture creation systems.

Connect with Neal on Linkedin.