The Governance Framework for Corporate Venture Studios

Balancing Autonomy with Strategic Alignment

How Corporate Venture Studios Navigate the Tension Between Speed and Control

Corporate venture studios face a fundamental challenge that determines success or failure: balancing the operational autonomy required for entrepreneurial effectiveness with the strategic oversight necessary for corporate alignment. Too much corporate control stifles the speed and experimentation venture building demands. Too little oversight creates strategic drift, wasted capital, and ventures that generate impressive metrics but limited corporate value. Getting this balance right requires sophisticated governance frameworks that most corporations lack experience designing.

Most corporate venture studios pursue one of two strategic theses. The dominant approach focuses on Horizon 2 adjacency expansion. Building businesses in adjacent markets, new customer segments, or product categories that leverage parent company assets like domain expertise, customer relationships, and operational capabilities. The GCV survey confirms this transformational innovation charter dominates corporate programs, with adjacencies and new business creation ranking as top priorities.

A smaller portion pursue Horizon 3 preparation for disruption. Exploring emerging technologies, business model innovations, or market shifts that could threaten core operations over 5-10 year timeframes. Horizon 2 studios require governance ensuring ventures remain within strategic adjacencies while enabling speed to capture market opportunities. Horizon 3 studios demand patient capital and tolerance for extended learning before commercial validation, with oversight focused on strategic relevance rather than financial performance. Understanding which thesis guides the studio provides essential context for every governance decision—the structures, delegation frameworks, and metrics that work for adjacency expansion may fail for disruption preparation.

The evidence suggests most corporations struggle with this balance. The Global Corporate Venture Builder 2025 report reveals that internal stakeholder management is one of the most frequently challenges within corporate venture studios. As Mark Simoncelli, former Chief Revenue Officer of Mach49, observes: “Most studios do not fail because of weak ideas. They fail because the governance does not fit the mission. Decision rights and incentives are usually the problem. You cannot ask a team to act like entrepreneurs and then govern them like a corporate project. The parent company often keeps too much control or pushes for short term results, which removes the flexibility a studio needs to succeed.” Programs fail not from poor venture ideas or insufficient capital but from governance structures that either suffocate entrepreneurial execution or fail to maintain strategic alignment. The corporations that master this governance challenge develop systematic advantages in venture building that competitors cannot easily replicate.

The Corporate Control Paradox

Corporate environments optimize for different objectives than venture building requires. Large organizations succeed through process consistency, risk management, and coordinated execution across thousands of employees. These characteristics create value in mature operations but undermine venture building where speed, experimentation, and tolerance for failure determine outcomes.

Consider procurement processes. A corporation negotiating enterprise software contracts achieves favorable economics through centralized purchasing, standardized evaluation criteria, and lengthy vendor selection processes. These same processes become destructive when applied to ventures needing to test multiple technology platforms in parallel, pivot quickly based on customer feedback, or deploy new tools within days rather than quarters.

HR policies create similar tensions. Corporate compensation frameworks emphasize internal equity, standardized career progression, and risk-managed incentive structures. Ventures require startup-style equity arrangements, non-standard titles that attract entrepreneurial talent, and performance incentives tied to venture success rather than corporate metrics. Imposing corporate HR frameworks on ventures makes recruiting competitive founding teams nearly impossible.

Legal and compliance requirements compound these challenges, particularly in regulated industries. Corporate legal teams properly emphasize risk mitigation, regulatory compliance, and liability protection. Ventures require rapid contract execution, experimental business models that existing compliance frameworks don’t address, and willingness to operate in regulatory gray areas while authorities develop appropriate oversight. Corporate legal’s instinct to delay until complete clarity exists conflicts with venture building’s need to move quickly and iterate based on market feedback.

The solution requires structural separation that provides ventures operational autonomy while maintaining strategic alignment through governance mechanisms rather than operational control. This separation ideally positions the studio as a separate legal entity, often a wholly-owned subsidiary, operating under corporate oversight with corporate mandates.

Structural Options and Trade-offs

Corporations can implement venture studios through several structural approaches, each with distinct implications for autonomy, alignment, and execution effectiveness.

Wholly-Owned Subsidiary Structure

The most common approach establishes the studio as a separate legal entity that is wholly owned by the parent corporation. This structure provides operational separation while maintaining full strategic control through ownership rights and board governance.

The GCV survey indicates approximately 20% of corporate venture building programs operate as separate specialist legal entities. This structure offers several advantages: ventures can establish independent hiring practices without corporate HR constraints, deploy capital more rapidly through separate procurement authority, experiment with business models that corporate compliance frameworks don’t easily accommodate, and maintain distinct brands that attract entrepreneurial talent uncomfortable associating with large corporations.

Legal separation creates tangible operational benefits. As Old Mutual’s Vuyo Mpako explained regarding Next176’s separate entity structure: “This means that any losses from the startup ventures are then not consolidated onto the Old Mutual balance sheet. It also gives the ventures more freedom to grow and experiment in the early stage.” This accounting treatment matters—it prevents venture failures from directly impacting corporate earnings while providing ventures genuine freedom to operate without quarterly earnings pressure.

However, complete separation creates coordination challenges. Studios need access to parent corporation assets, such as customer relationships, domain expertise, technology infrastructure, and regulatory licenses that provide competitive advantages. Simoncelli emphasizes this tension: “The strongest ventures work with their parent company, not despite it. When ventures have access to brand, customers, and talent combined with autonomy, they gain real advantages. But it is a balance. Too much integration leads to incremental ideas. Too much distance and the venture loses momentum.” Too much independence undermines the strategic rationale for corporate venture building versus external venture capital. The governance framework must maintain access to corporate advantages while preventing corporate processes from constraining execution speed.

Integrated Internal Unit Structure

Approximately 34% of GCV survey respondents operate within integrated corporate venturing units that combine M&A, partnerships, CVC, and venture building. Another 17% function as standalone internal units within corporate development. These approaches maintain ventures within corporate legal entities while attempting operational separation through organizational structure.

Internal structures offer advantages in resource access and strategic coordination. Ventures can leverage corporate infrastructure, access business unit expertise without negotiation overhead, and maintain tight alignment with corporate development strategic planning. Integration costs prove lower than separate entities and political barriers to resource sharing decrease when ventures operate within familiar corporate structures.

The operational constraints prove significant. Internal ventures face corporate procurement, HR policies, and compliance frameworks that slow execution. Budget approval cycles follow corporate planning rhythms rather than venture needs. Compensation constraints make attracting entrepreneurial talent challenging. Most critically, allocating corporate resources to venture studio support is rarely proritized over the needs of the business unit, resulting in consistent delays and overall poor reliability in execution support, jepordizing the ability for the venture studio to demonstrate progress. Making them visible targets for quarterly cost reductions when corporate performance pressure increases.

Scaling beyond experimentation typically requires the operational autonomy that separate entity structures provide. SC Ventures demonstrates this evolution: while integrated within Standard Chartered’s corporate structure as an experiement, it has grown to become a business unit itself, growing to 100+ people, with a headcount of over 2,000 across all incubation and commercial ventures. The business unit includes VC investment as well, with venture building accounting for the majority of personnel and activity.

Portfolio Company Structures

Corporate studios have critical choices on how and when to establish legal entities for portfolio companies. Some corporate venture studios treat all new opportunities as internal projects. Only creating a legal entity if the opportunity will be spun out and operated independently at the end of the studio support period. Some corporates create entities for each opportunity from day one to create legal and reporting separation for each portfolio company. With 43% of corporate studios targeting spin-ins as the end goal, many corporate studios take a hybrid approach incorporating new entities as the opportunity matures.

As Jasdeep Sawhney of InMotion Ventures Studio explained: “We’re never sure right from the beginning whether a venture is going to spin in or spin out. Even if it does spin into the corporate, we feel it’s easier to maintain risk, acquire talent and have an easy separation of talent between different ventures when we incorporate a legal entity.” This venture-level separation provides ultimate flexibility—ventures that succeed can integrate into business units, spin out to external investors, or continue as subsidiaries based on strategic fit and market opportunities.

The governance complexity increases with multiple entity structures but this investment creates strategic optionality worth the overhead. Corporate development teams already manage similar complexity with CVC portfolio companies and strategic partnerships. Extending proven governance frameworks to venture studios requires adaptation rather than wholesale capability development.

Reserved Matters and Delegation Framework

Simoncelli describes the governance solution as operating at “two speeds”: “One moves quickly for venture building, guided by milestones and market validation. The other checks in periodically for strategic fit. The boundaries should be clear from the start, and then the team needs freedom to execute within them.” Effective governance balances autonomy with control through clear boundaries around reserved matters requiring parent company approval and delegation of operational decisions to studio management.

Strategic Reserved Matters

Certain decisions carry sufficient strategic implications or risk exposure to warrant parent company involvement:

Capital deployment above defined thresholds: Studios should receive pre-approved capital envelopes for venture building and service operations. Typically $3-5 million annually based on GCV data showing most ventures cost $500,000-$1 million depending on the pace of new company creation and studio team size. Investments exceeding these thresholds or requiring parent company balance sheet commitments flow through corporate development capital approval processes.

Activities involving strategic competitors: When ventures contemplate partnerships with competitors, licensing arrangements that could enable competitive threats, or service operations serving competitors, corporate development should evaluate strategic implications. This doesn’t mean prohibiting such arrangements but ensuring conscious strategic decisions rather than inadvertent competitive disadvantages.

Intellectual property transfers: Moving valuable IP from parent corporation to ventures or licensing parent IP to ventures requires explicit approval. IP represents strategic assets with implications beyond individual ventures. Corporate development should evaluate whether IP transfers create sustainable venture advantages or simply donate valuable assets that could generate returns through alternative monetization.

Expansion beyond defined adjacencies: Studios should operate within strategic adjacency parameters established at formation. Expansions into new markets, customer segments, or business models outside these parameters require corporate validation. This prevents mission creep where studios pursue attractive opportunities misaligned with parent corporation strategic objectives.

Venture exit decisions: Integration into business units, subsidiary structures, minority spinouts, or licensing arrangements warrant corporate involvement given implications for parent corporation strategy, capital deployment, and organizational structure.

Operational Delegation

Within strategic boundaries, studios require operational autonomy:

Venture development decisions: Which ideas to pursue, team composition, technology selections, and go-to-market approaches represent operational execution that studio teams understand better than corporate development oversight. Corporate development should evaluate milestone achievement, not micromanage how teams reach those milestones.

Venture mix strategy: The scope and scale of which opportunities fit what return profile and exit strategy, within corporate mandates for the studio. Opportunities mature through ideation, validation, and build as customer discovery, service delivery, and business models evolve with real world feedback. The decision on the right build strategy and targets require speed, high risk and low information tolerance, that corporate review cycles undermine.

Hiring and compensation: Within budget parameters, studios need autonomy to recruit talent using compensation structures that attract entrepreneurial teams. This includes startup-style equity, non-standard titles, and performance incentives misaligned with corporate frameworks. Only 20% of corporate venture builders offer startup equity per GCV data, this is a constraint that significantly limits talent attraction, reportedly the most common challenge among corporate venture studios. Studios with hiring autonomy overcome this competitive disadvantage.

“Another challenge has been staffing. Schenker Ventures has not yet found a viable solution for offering startup-style equity to founders that build the ventures in which the company retains majority ownership, and so it can be challenging to find the right entrepreneurial talent.” — Tom Schneider, Schenker Ventures

Partner and vendor selection: Portfolio companies should select technology vendors, service providers, and partners without corporate procurement process constraints. Speed matters more than incremental cost savings. The weeks or months corporate procurement requires for vendor evaluation destroy venture momentum. Studios can establish spending limits requiring corporate approval (typically $50,000-$100,000 thresholds) while maintaining autonomy for routine decisions.

The delegation framework should codify these boundaries in governance documents—operating agreements for LLCs, bylaws and board resolutions for C-Corps. Written documentation prevents ambiguity about decision authority and provides studio teams confidence to execute without seeking permission for routine operational choices.

Board Composition and Information Rights

Board governance determines how strategic oversight operates in practice. Effective boards balance parent company strategic interests with venture building execution requirements and expertise.

Corporate Representation

Parent company board seats typically include the corporate executive that is the champion and reporting path for the studio, a corporate development or corporate strategy representative, and potentially a finance executive. This composition ensures strategic alignment while providing financial discipline.

Venture Builder, Independent and External Members

Corporate studios benefit from external board members who provide venture building expertise, entrepreneurship experience, and independence from parent corporation political dynamics. These members might include venture capitalists with relevant sector experience, successful entrepreneurs who’ve built companies in adjacent markets, or operating executives from non-competing corporations with venture building experience.

External members provide several benefits: They challenge both studio management and parent company representatives when plans lack rigor or strategic assumptions prove questionable. They bring portfolio pattern recognition from observing dozens of ventures rather than the handful most corporate executives encounter. They provide air cover for difficult decisions—shutting down underperforming ventures, pivoting from initial strategies, or pushing back on corporate interference that undermines execution.

The trade-off involves confidentiality and coordination complexity. External members increase board size and introduce confidentiality concerns when ventures leverage parent company strategic intelligence.

Board Size

Board size matters for execution velocity. Venture boards function most effectively with 3-5 members during early development. Larger boards slow decision-making and introduce competing agendas that undermine focus. Corporate parents should resist the temptation to add representatives from every stakeholder function. Board observer rights should be limited. While they can provide transparency without expanding voting membership, in practice, everyone in the room has a voice in decisions even if they lack a formal vote.

Keeping boards balanced between corporate representation and venture builder representation is critical. Corporate executives demand greater rigor, certainty, and knowledge for decisions than is realistic in the early stages of venture creation. Venture builders and entrepreneur representatives bring more risk acceptance, a bias to action, and awareness of the realities of early stage company building that balances the expectations of corporate executives.

Information Rights and Reporting Cadence

Board governance requires appropriate information flow without creating reporting burden that consumes management bandwidth. Effective frameworks typically include:

Quarterly board meetings reviewing portfolio performance, strategic development, capital deployment, and key risks. This cadence aligns with corporate planning cycles while providing sufficient frequency for meaningful oversight without excessive meeting overhead.

Monthly dashboard reporting tracking key metrics: venture development milestones, capital deployed versus budget, talent acquisition, and intelligence engine utilization by corporate functions. Dashboards should focus on decision-relevant metrics rather than comprehensive activity reports.

Exception reporting for developments requiring immediate board attention: ventures achieving inflection points requiring capital decisions, competitive threats, strategic opportunities, regulatory challenges, or organizational issues. Exception reporting enables rapid response without waiting for quarterly meetings.

Annual strategic planning establishing studio objectives, capital allocation, adjacency focus areas, and success metrics for the coming year. This planning should align with corporate development strategic cycles while preserving studio autonomy around execution approaches.

Competitive Considerations and Information Barriers

Studios generating market intelligence through portfolio businesses and customer discovery must implement information governance to manage competitive and legal risks.

The Intelligence Paradox

Portfolio companies create market intelligence value precisely because they operate in markets where parent corporations compete, partner, and evaluate opportunities. This positioning generates unique insights about competitor capabilities, partnership opportunities, and acquisition targets. However, accumulating information about competitors and partners creates concerns about appropriate use, particularly in regulated industries with strict information barrier requirements.

The intelligence engine that corporate studios often become must balance comprehensive market understanding with appropriate information protection. This requires multiple layers of governance:

Portfolio Company Information Barriers: Portfolio businesses should operate with brand independence and separate management teams that don’t automatically share competitively sensitive information with parent corporations. Information sharing should flow through structured intelligence processes rather than ad-hoc conversations that could create regulatory exposure.

Data Anonymization and Aggregation: Intelligence engines should anonymize and aggregate customer insights before making them available to corporate development teams. Rather than providing identifiable information about specific competitor conversations, the engine surfaces patterns across dozens of interactions that inform strategic decisions without exposing proprietary competitive intelligence.

Access Controls Based on Permissions: Different corporate functions should receive intelligence appropriate to their roles. M&A teams might access detailed information about potential acquisition targets while business units receive only aggregated market trend data. This tiered access approach mirrors information barriers corporate development teams already maintain for M&A due diligence.

Corporate development positioning provides natural frameworks for managing these challenges. M&A teams routinely establish “clean rooms” for sensitive information during acquisition diligence, implement information barriers between deal teams working on competing transactions, and manage conflicts of interest when evaluating investments in companies competing with business units. Extending these frameworks to venture studio intelligence management leverages existing expertise rather than developing novel capabilities.

Practical Implementation Approaches

Leading corporate studios implement several specific practices:

Separate branding and market positioning: Portfolio businesses operate under distinct brands that don’t obviously connect to parent corporations. This enables customer candor in conversations. Customers share competitive intelligence they would withhold if explicitly working with a competitor’s subsidiary.

Third-party data platform hosting: Intelligence engines can reside on third-party platforms with access controls that prevent unauthorized data exposure. This architectural approach creates technical barriers reinforcing governance policies.

Regular compliance auditing: Reviews by corporate legal counsel verify that information governance policies are properly implemented and identify potential exposure before problems escalate. These audits should evaluate both technical controls and operational practices.

Clear escalation procedures: When service companies encounter competitively sensitive information that corporate teams might want to access, documented procedures should govern evaluation of whether sharing serves legitimate strategic purposes without creating legal exposure.

Success Metrics and Performance Accountability

Governance frameworks should establish clear success metrics that align studio incentives with parent corporation strategic objectives while respecting venture building’s inherent uncertainty.

Near-Term Venture Metrics

Venture development milestones should track progress through systematic validation stages rather than financial performance premature for early-stage companies: ideas worth pursuing, opportunities validated as worth building, early revenue commitments from customers, and revenue generation. These milestones provide confidence that ventures progress appropriately without demanding profitability before market validation completes.

Long-Term Strategic Returns

Exit outcomes ultimately determine venture building success, but the definition of success depends entirely on why the studio exists. Studios pursuing Horizon 2 adjacency expansion should measure integration values for business unit acquisitions, subsidiary profitability for majority-owned entities, and return multiples for spinouts—with primary emphasis on revenue contribution to parent corporation growth targets. Studios chartered for Horizon 3 disruption preparation measure strategic options created (validated alternative business models available for scaling), organizational learning velocity (improved capability to recognize and respond to disruption), and technology validation efficiency, with financial returns as secondary validation of strategic relevance rather than primary objectives. The governance framework must establish which strategic thesis drives the studio, then structure compensation and board evaluation against corresponding success metrics rather than applying uniform financial return expectations that optimize for wrong outcomes.

Portfolio Construction and Strategic Value of Corporate Venture Studio

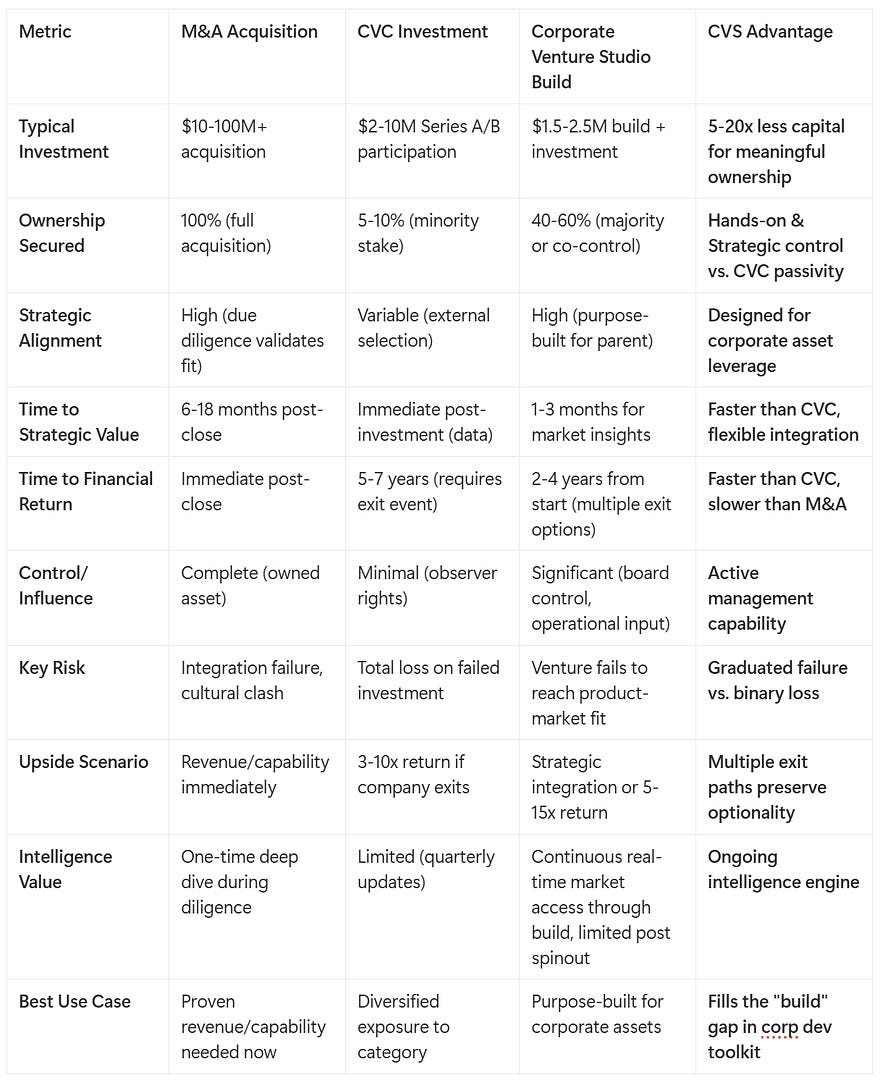

The economic and strategic case for adding venture studios to the corporate development toolkit becomes clear when comparing what each approach actually delivers. M&A provides complete ownership and immediate capability but requires significant capital and carries substantial integration risk. CVC enables portfolio diversification across emerging categories but delivers minimal control and requires 5-7 year holding periods before liquidity events create strategic value. Venture studios build purpose-designed businesses that leverage corporate assets, securing meaningful ownership stakes at substantially lower capital intensity while generating continuous market intelligence as operations proceed. Understanding the distinct characteristics of each approach enables corporate development teams to construct portfolios that balance immediate needs, medium-term strategic positioning, and long-term optionality creation.

Capital efficiency metrics enable venture studio comparison to M&A and CVC alternatives: cost per venture built, time to market validation, and capital deployed relative to equity value created. If for example building ventures for $2M including investment, creates a 50% ownership stake, effectively securing a point of equity for every $40,000 invested. This cost of equity compares favorably to corporate venture investing where Series A participation may only secure 5% for $2M, resulting in a point for every $400,000, a 10x more expensive investment. An acquisition would require event more capital, generally from $10M on up, securing 100% of the equity. When a venture studio can adequately control for risk and leverage the assets and network of the parent corporation, the capital efficiency and risk advantage becomes a clear advantage.

The comparison reveals that these tools complement rather than compete with each other. Studios don’t replace M&A when proven revenue and established teams are required immediately. CVC remains valuable for gaining exposure to categories where the corporation lacks domain expertise to build effectively. But studios fill a critical gap: building businesses specifically designed to leverage parent company assets in strategic adjacencies where external options don’t exist or arrive at valuations that make acquisition economics unfavorable. The portfolio construction question becomes not whether to use studios, but what percentage of corporate development capital should flow to each approach based on strategic priorities and market conditions.

Comparing Corporate Development Approaches

Portfolio Construction Implications: Each approach serves different strategic needs. M&A delivers immediate capability but requires significant capital and carries integration risk. CVC provides portfolio diversification but minimal control and long liquidity timelines. Studios build purpose-designed ventures with meaningful ownership at lower capital intensity, generating continuous market intelligence as a byproduct.

Studios achieve 10-15x better capital efficiency than M&A and 3-4x better than CVC while maintaining strategic control through meaningful ownership stakes. The approach enables flexible exit paths including integration, subsidiary operations, or spinouts based on evolving strategic fit and market conditions.

Hidden Value Stream: Strategic Optionality Through Low-Cost Insurance

The most sophisticated corporate venture studio applications involve Horizon 3 exploration, where studios function as strategic insurance policies validating alternative business models at minimal cost before disruption forces expensive crash programs. Consider an automotive manufacturer facing potential mobility-as-a-service disruption: building a validated subscription platform through a studio may cost $2-4 million over 18-24 months. If vehicle ownership patterns shift dramatically or the business model starts to gain traction, the corporation can immediately scale this validated model while competitors scramble to build equivalent capabilities.

The enterprise value difference between market leadership and fast-follower status in a disrupted category easily reaches $50-200 million. Even assigning modest 20% probability to significant disruption yields option value of $10-40 million against $2-3 million investment, a 5-20x return before counting direct financial returns. This insurance function delivers value in both exercise and non-exercise scenarios: if disruption materializes, the validated model provides immediate response capability; if disruption doesn’t occur, the validated negative knowledge prevents wasteful investments when competitors promote similar concepts. The Global Corporate Venture Builder 2025 report confirms that studios pursuing Horizon 3 preparation emphasize this strategic positioning and organizational learning over near-term financial returns.

Enabling Strategic Success Through Governance Design

Corporate venture studios succeed or fail based on governance frameworks that balance competing tensions. Too much control stifles entrepreneurial execution. Too little coordination undermines strategic value creation. The optimal balance requires:

Structural separation through wholly-owned subsidiaries or equivalent operational autonomy that removes corporate process constraints while maintaining strategic alignment through ownership and governance rather than operational control.

Clear delegation frameworks specifying reserved matters requiring corporate approval and operational decisions residing with studio management, codified in governance documents that prevent ambiguity about decision authority.

Appropriate board composition balancing parent company strategic representation with venture building execution requirements, sized for decision velocity rather than stakeholder representation.

Sophisticated information governance managing the intelligence paradox through corporate development frameworks that leverage existing M&A and CVC expertise in information barriers, competitive considerations, and appropriate use policies.

Balanced performance metrics emphasizing near-term commercial validation and intelligence value creation, medium-term venture development progress, and long-term strategic returns evaluated on timeframes realistic for venture building rather than corporate planning cycles.

The corporations that master these governance challenges develop systematic competitive advantages in venture building. They move faster than competitors constrained by corporate processes. They attract better entrepreneurial talent through operational autonomy. They generate superior market intelligence through service businesses that corporate structures enable. They build ventures that create both strategic value for parent corporations and commercial success in external markets.

Most critically, effective governance transforms venture building from experimental initiatives vulnerable to organizational immune responses into institutional capabilities that enhance corporate development strategic frameworks systematically and profitably. The governance investment required to achieve this transformation pays dividends across every dimension of corporate growth strategy—completing the build-buy-partner framework that most corporations leave incomplete.

Citations:

https://2025.globalventurebuilding.com; Accessed through https://globalventurebuilding.com

https://newsletter.venturestudioforum.org/p/the-quality-first-revolution

https://newsletter.venturestudioforum.org/p/the-eight-driver-framework-for-venture

https://newsletter.venturestudioforum.org/p/the-venture-studio-index-whitepaper

https://newsletter.venturestudioforum.org/p/the-four-customer-challenge-for-venture

https://www.linkedin.com/in/mark-simoncelli-45636813/

About the Author

Matthew Burris serves as the Senior Director of Research at the Venture Studio Forum, where his mission is to transition venture studios from an emerging asset class to an established asset class. In this role, he leads the creation of the rigorous data frameworks and due diligence standards required for institutional adoption.

This research is built upon the proprietary insights Matthew developed as Partner & Head of Insights at the 9Point8 Collective and study of over 500 venture studios globally. By codifying the methodologies from his advisory work with corporate, university, economic development, and private studios, he provides the Forum with the foundational architecture needed to define the industry.

Connect with Matthew on LinkedIn.